Collective on Geoeconomics

24th January 2023

1] INTRODUCTION

According to a World Bank Report, extreme poverty has increased. Concurrently, extreme wealth has also dramatically risen since the Covid-19 pandemic began.

The report shows that while the richest 1 percent captured 54 percent of new global wealth over the past decade, this has accelerated to 63 percent in the past two years. US$42 Trillion of new wealth was created between December 2019 and December 2021. US$26 Trillion (63 percent) was captured by the richest 1 percent, while US$16 Trillion (37 percent) went to the bottom 99 percent. According to Credit Suisse, individuals with more than US$1 million in wealth sit in the top 1 percent bracket.

Further, in the Oxfam publication: “Survival of the Richest” indicates that the richest 1 percent grabbed nearly two-thirds of all new wealth worth US$42 Trillion created since 2020, almost twice as much money as the bottom 99 percent of the world’s population.

For the past decade, the richest 1 percent had captured around half of all new wealth. Indeed, billionaires have gained extraordinary increases in their wealth.

Since 2020, during the pandemic and cost-of-living crises, US$26 Trillion (63 percent) of all new wealth was captured by the richest 1 percent, while US$16 trillion (37 percent) went to the rest of the world put together. A billionaire gained roughly US$1.7 million for every US$1 of new global wealth earned by a person in the bottom 90 percent. Billionaire fortunes have increased by US$2.7 billion a day. This comes on top of a decade of historic gains where the number and wealth of billionaires doubling over the last ten years.

2 HOW ARE THE IMMENSE WEALTH ACCUMULATED?

The wide wealth disparity between the ultra-rich and the poverty poors emerges from the coarse profits from the food and energy sectors. Billionaire wealth surged in 2022 with rapidly rising food and energy profits. The report shows that 95 food and energy corporations have more than doubled their profits in 2022. They made US$306 billion in windfall profits, and paid out US$257 billion (84 percent) of that to rich shareholders. The Walton dynasty, which owns half of Walmart, has received US$8.5 billion over the last year. Indian billionaire Gautam Adani, owner of major energy corporations, has seen this wealth soar by US$42 billion (46 percent) in 2022 alone.

It is stated in Oxfam 2023, “Survival of the Richest: the Indian Story” that 5 per cent of Indians own more than 60 per cent of the country’s wealth while the bottom 50 per cent of India’s population possess only three per cent of the wealth. From 2012 to 2021, 40 per cent of the wealth created in India has gone to just one per cent of the population and only a mere 3 per cent of the wealth has gone to the bottom 50 per cent. The combined wealth of India’s 100 richest has touched US$660 billion.

In Spain, the CCOO (one of the country’s largest trade unions) found that corporate profits are responsible for 83.4 percent of price increases during the first quarter of 2022.

Further, in the U.S., the UK and Australia, studies have found that 54 percent, 59 percent and 60 percent of inflation, respectively, was driven by increased corporate profits.

3 WHERE DOES THE INEQUALITY ARISES?

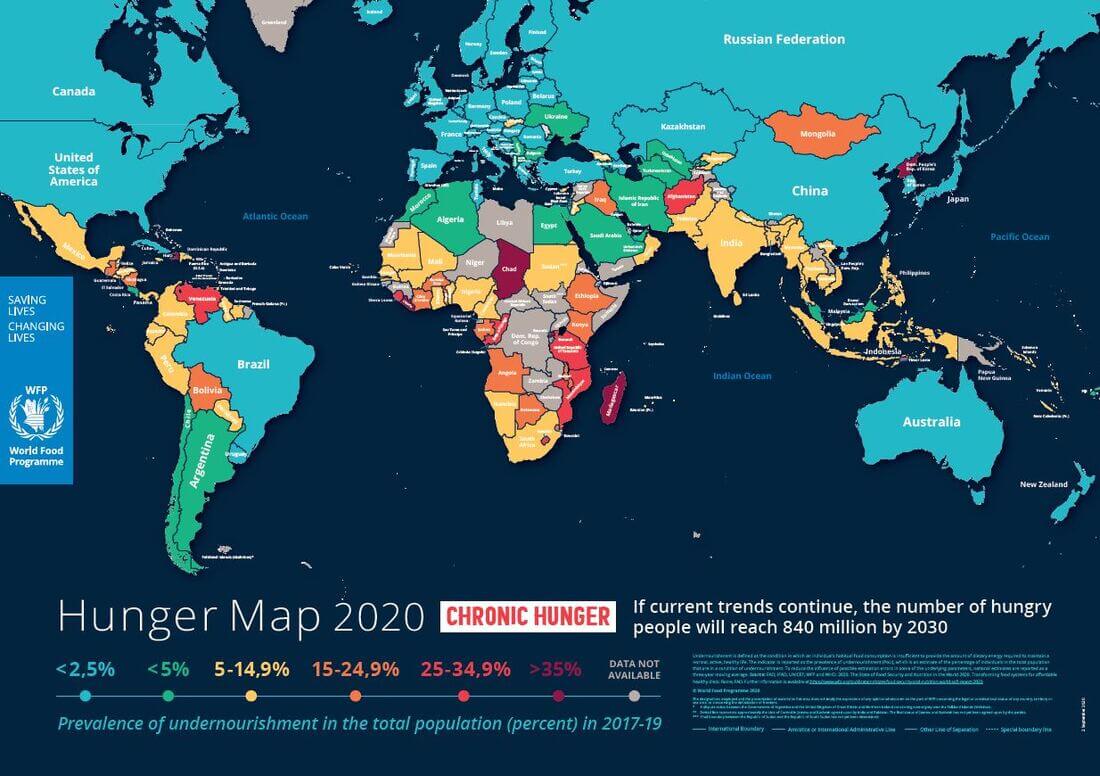

This spectre of inequality, and the immense wide-spread in hunger, occur increasing under an inflationary trend. At a time when at least 1.7 billion workers are living in countries where inflation is outpacing wages, and over 820 million people – that is, one in ten people on Earth – are presently going hungry everyday. Women and girls often eat least and last, and make up nearly 60 percent of the world’s hungry population. As indicated in various reports, the World Bank says we are witnessing the biggest increase in global inequality and poverty since World War 2.

Entire countries are facing bankruptcy, with the poorest countries now spending four times more repaying debts to rich creditors than on healthcare. Three-quarters of the world’s governments are planning austerity-driven public sector spending cuts – including on healthcare and education – by US$7.8 Trillion over the next five years.

Thus, debt is hunger.

4 HOW FINANCIAL MONOPOLY CAPITALISM DOMINATES?

In the New Political Economy, 30 Mar 2021 article by the Jason Hickel, Dylan Sullivan and Huzaifa Zoomkawala research team presents that wealth drain from the Global South remains a substantial feature in post-colonial global economy; rich countries continue to indulge in imperial forms of appropriation to sustain their high levels of income and spending.

For instance, prominent transnationals have had an important presence in the Brazilian agrifood industry since its birth; players include: Nestlé, Unilever, Anderson Clayton, Corn Products Company, Dreyfus, and the Argentine transnational Bunge y Borne (now simply Bunge). They were later followed, as different markets matured, by Kraft, Nabisco, General Foods, and Cargill from the United States, and United Biscuits, Bongrain, Danone, Parmalat, and Carrefour from Europe. The immediate consequences are that uneven and often uncoordinated foray of metropolitan corporate capital is subjugating the agriculture and domestic food markets of many developing countries, particularly smaller, peripheral ones undergoing rapid urbanization, to the needs of global agribusiness monopoly-capital; read Ukraine’s Big Farms’ global agribusiness land grab.

Then during the 1990s’, unrestricted movement of international finance capital, public sector enterprises or government-link companies (GLCs) increasingly are subjected under the hound of financialization capitalism. The metropolitan capital-as-finance (Patnaik 1999), gets control over Third World resources and enterprises to see the rise to international finance capital in league with the local neocomprador class becoming crony capitalism through the force of accumulation as articulated by Samir Amin (2019) in The New Imperialist Structure, Monthly Review, July 01, 2019. Anchored upon a capital-market system, this leads to the emergence to, and the pervasion of, financialization capitalism in Malaysia.

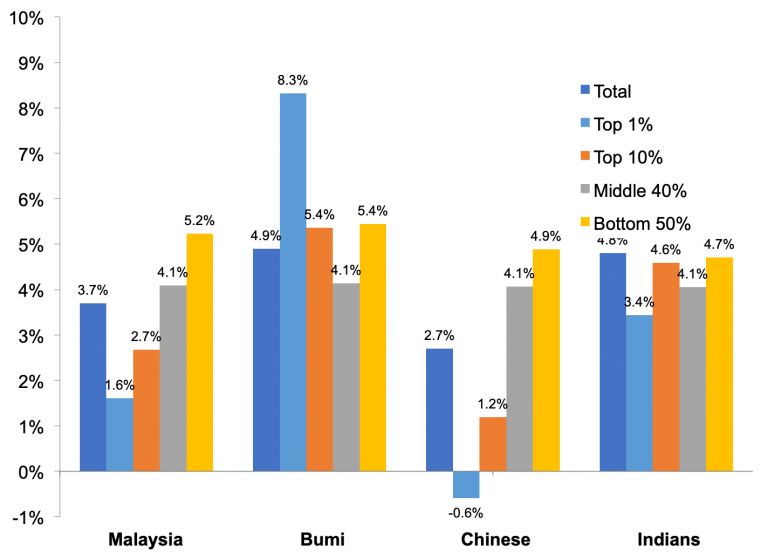

With globalisation, rentier capitalism compradores attaching to neo-imperial monopoly capitalism and their linkages to the global commodity chain dimension, the consequence is that these capitalists are accentuating wealth disparity with the working class; see Khalid 2019 study where the absolute gap across income groups has increased, contributing to big chunk of the poverty poors being left behind. The top 20% of population – the T20 – possess 46.2% of the national income share, while M40 have 37.4% of the national income share.

5 WHAT TO DO?

According to various analyses by the Fight Inequality Alliance, Institute for Policy Studies, Oxfam and the Patriotic Millionaires, an annual wealth tax of up to 5 percent on the world’s multi-millionaires and billionaires could raise US$1.7 trillion a year, enough to lift 2 billion people out of poverty, fully fund the shortfalls on existing humanitarian appeals, deliver a 10-year plan to end hunger, support poorer countries being ravaged by climate impacts, and deliver universal healthcare and social protection for everyone living in low- and lower middle-income countries.

Oxfam is calling on national governments to:

• Introduce one-off solidarity wealth taxes and windfall taxes to end crisis profiteering.

• Permanently increase taxes on the richest 1 percent, for example to at least 60 percent of their income from labor and capital, with higher rates for multi-millionaires and billionaires. Governments must especially raise taxes on capital gains, which are subject to lower tax rates than other forms of income.

• Tax the wealth of the richest 1 percent at rates high enough to significantly reduce the numbers and wealth of the richest people, and redistribute these resources.

This includes implementing inheritance, property and land taxes, as well as net wealth taxes. There are 80 percent of Indians, 85 percent of Brazilians and 69 percent of citizens polled across 34 countries in Africa are supporting increasing taxes on the rich.

Our leading economists are calling:

“This is precisely the time when you must reform taxes as you have it (windfall tax) all the time amid extraordinarily high petroleum prices or palm oil prices,” according to Khazanah Research Institute senior advisor Professor Dr Jomo Kwame Sundaram.

Institute of Malaysian and International Studies research fellow Dr Muhammed Abdul Khalid pointed out that policymakers tend to ignore the imposition of capital gains tax when it comes to the issue of tax reform. “Taxes must be fair ….. and we never talk about the urgency of imposing capital gains tax, maybe because it is going to affect the very well-off in Malaysia,” he said.

Indeed, there should be greater effort across tax instruments: to increase the progressivity of personal income tax, re-examine the number and targeting of corporate income tax incentives and to consider new sources of revenue such as environmental taxation and capital gains taxation. The introduction of capital gains tax, raising the tax rate for those in the top individual tax bracket and imposing a tax on retirement savings above a certain threshold were among the suggestions on how to enhance revenue in the World Bank Report, 2021, Malaysia Economic Monitor June 2021: Weathering the Surge.

EPILOGUE

Oxfam’s research shows that the ultra-rich are also the biggest individual contributors to the climate crisis. The richest billionaires, through their polluting investments, are emitting a million times more carbon than the average person. The wealthiest 1 percent of humanity are responsible for twice as many emissions as the poorest 50 percent and by 2030, their carbon footprints are set to be 30 times greater than the level compatible with the 1.5°C goal of the Paris Agreement.

Related Readings