PROLOGUE

The clientel [place] had aligned with monopoly-capital [positions] in promoting rentier capitalism to sustain their hold on [power]. They adopt this clientelism as solicitations for votes at the grassroots level, allowing ruling elites [place] the party patronage [position] and political [power].

1] INTRODUCTION

The root of COVID-19 pandemic is a crisis of globalization, a crisis of neo-colonialism, a crisis of ethnocratic capitalism, a crisis of the socio-economic management of our healthcare.

A) CRISIS OF GLOBALIZATION

According to the World Trade Organization, the economic fallout from the COVID-19 pandemic would lead to a drop in annual world trade in 2020 by 13 percent in the more optimistic scenario, and by 32 percent in the more pessimistic scenario. In the latter case, the collapse of world trade would equal in one year what happened in the Great Depression of the 1930s over a three-year period, (World Trade Organisation, Trade set to Plunge as Covid-19 Pandemic Upends Global Economy, WTO, April 8, 2020).

A paper in the New Political Economy (henceforth referred as NPE 2021) published online: 30 Mar 2021 – by Jason Hickel, Dylan Sullivan and Huzaifa Zoomkawala contended that wealth drain from the Global South remains a significant feature of the world economy in the post-colonial era; rich countries continue to rely on imperial forms of appropriation to sustain their high levels of income and consumption.

The researcher-authors discover that the Global North had appropriated from the Global South commodities worth US$2.2 trillion in Northern prices that are enough to end extreme poverty 15 times over. Over the 1960–2018 period studied, the value drain from the Global South totalled US$62 trillion (at constant 2011 US dollars), or US$152 trillion when accounting for the Global South countries’ lost growth. Indeed, it is found that the appropriation through unequal exchange represents up to 7% of Global North’s GDP and 9% of Global South GDP.

B) CRISIS OF NEO-COLONIALISM

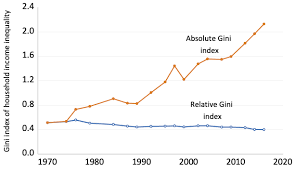

That post-independence under continuance of neo-colonialism and the neoliberalism “economic development” approach ensue growth did not trickle down to everyone, and that only the well-connected capital cronies who, through rentier capitalism and clientele corruption, had enjoyed the immense wealth of development. There had been a marked rise in absolute inequality in Malaysia through the years:

C) CRISIS OF ETHNOCAPITALISM

The past forty years, however, our healthcare policies have reduced health services as part of financialization capitalism, see John Bellamy Foster, “The Financialization of Capitalism,” Monthly Review 58, no. 11 (April 2007). An outcome of this excessive splurging of money is that a small class faction controls increasingly large portions of social wealth, best described as “plutonomies”, see “Revisiting Plutonomy: The Rich Get Richer,” Citigroup Research, March 5, 2006.

The objectives of dominant monopoly-capitalism are still the same: controlling market expansion (TNCs), destruction of natural resources (Big Farms), and peripheral labour reserves exploitation (Global Value Chains), by colluding with local compradore capital in allegiance to this Global North malfeasance, (Samir Amin, Imperialism and Globalization, Monthly Review June 2001 and The New Imperialist Structure, Monthly Review July 2019), while rakyat2 are burdened with economic stagnation where those urban unemployed or have lower working hours with lower pay are having greater challenges in accessing healthcare.

D) CRISIS OF HEALTHCARE

In 1983, premier Mahathir introduced policies allowing the private sector to encroach upon the public healthcare and public education sectors. The encouragement to privatization leads to an unrestrained privatization in healthcare, including medical and pharmaceutical supplies, that cause healthcare costs rising considerably. This lead to a widening in social inequalities not only in healthcare service provision but impact upon widening gaps between different classes on their working and living conditions.

2] THE CLIENTEL CAPITALISM CONTINUES

Malaysia has spent RM3.5 billion to procure Covid-19 vaccines for 120% of the population in Malaysia or 38.5 million people, said Covid-19 Immunisation Task Force (CITF); that the overall budget for Malaysia’s National Covid-19 Immunisation Programme was RM5 billion, as it included the cost of implementing the programme itself, with RM3.5 billion spent on vaccine procurement.

The country received the second batch of COVID-19 vaccines, shipped via the COVAX Facility, or COVID-19 Vaccine Allocation Plan, a partnership between the World Health Organization (WHO), the Coalition for Epidemic Preparedness Innovations (CEPI), Gavi, and the United Nations Children’s Fund (UNICEF), ensuring an important step in the fight against the COVID-19 pandemic.

The 559,200 doses of AstraZeneca vaccines had arrived following the April 21st 2021 COVAX shipment of 268,800 doses to Kuala Lumpur, Malaysia. In total, Malaysia has received 828,000 doses of the expected 1,387,200 doses of AstraZeneca vaccine provided by the COVAX Facility.

The national vaccination rate had reached 100,000 doses a day since May 27 and the target now is to achieve 200,000 doses by the end of July 2021; and the vaccination rate to hit 300,000 a day by August 2021, (New Straits Times, 8th. June 2021).

The ruling regime vaccine coordinating minister Khairy Jamaluddin denies deliberately delaying administration of Covid-19 vaccines and dismissed accusations that the federal government had not been helpful in allowing state governments from buying their own vaccines after opposition members had claimed that the federal government had stonewalled attempts by Selangor and Sarawak state governments as well as private entities from getting their own government-approved vaccine supplies, (channelasianews, 20th. April 2021).

However, the state governments or private hospitals intending to acquire Sinopharm and Moderna products need to register these purchases with the Health Ministry’s National Pharmaceutical Regulatory Agency (NPRA), adding another layer of clientele capitalism control.

Further, if these parties wish to purchase vaccines that are used in the NIP such as Sinovac and Pfizer-BioNTech vaccines, then they will have to wait for the suppliers to fulfil the federal government’s orders first.

The vaccines currently used in Malaysia’s NIP are Pfizer-BioNTech, Sinovac and AstraZeneca. Other vaccines that have been approved by WHO include Moderna and Sinopharm.

3] THE MONOPOLY-CAPITALISM PROCESS

In a crisis under an Ecological-Epidemiological-Economic environment, the control and distribution of vaccines has entangled oligarchy associates with Big Pharma capital linking to Global North monopoly capital and its financialisation capitalism domain.

That an unfavourable arrangement whereby Pharmaniaga – the premier privatised pharmaceutical company – would source for required medicines and sell them to the Health Ministry at a pre-determined price with an additional mark-up and commission rate to cover the costs of distribution, inventory holding and procurement is not only a disturbing trend, but a reality in clientel capitalism where rent-seeking is a norm insofar capitalism breeds unlovely opulence among the few, and immiseration of the many.

As early as January 12, 2021, Pharmaniaga had partnered China’s Sinovac Life Sciences Co Ltd for the supply of the 14 million doses of Covid-19 vaccine, enough to cover 22% population in Malaysia. The country has received Sinovac’s first 200-litre Covid-19 vaccines on 27th. February, 2021, equalling to 300,000 doses.

Pharmaniaga’s wholly-owned subsidiary Pharmaniaga LifeScience Sdn. Bhd. (PLS) had also entered into a term sheet agreement with the Ministry of Health (MoH) for the purchase and distribution of the vaccine developed by Sinovac Life Sciences Co Ltd (Sinovac LS), a subsidiary of Sinovac Bi-otech Ltd., (theedge, 27/01/2021). The agreement will enable PLS to supply doses of finished Covid-19 CoronaVac, SARS-CoV-2 Vaccine (Vero Cell), Inactivated (developed by Sinovac LS), and filled and finished by PLS to be delivered to hospitals, clinics and any other facilities nationwide as instructed by MoH.

In the rollout of vaccination, the spectre of ethnocratic administration and rentier capitalism should not be eclipsed from public knowledge especially when bumiputera ethnocapital agents act as intermediaries between government hospitals on one hand, and foreign and Malaysian non-bumiputera pharmaceutical companies on the other, who bid for public procurement of drugs and other medical supplies. In fact, this class of ethnocapital tendering agents shall continue to provide additional services like warehousing and distribution, while other bumiputera shall continue to assume purely as intermediary middlemen. These ethnocapital tender agents charge a fee of between 2 per cent and 3 per cent for their services.

Further, unlike typical logistics companies that charge shipping based on product weight and distance of the destination, Pharmaniaga charges MoH a percentage of the value of products purchased to cover logistics and distribution expenses, even though the MoH owned the IT system developed by Pharmaniaga to manage drug procurement.

4] ] THE CLIENTEL COLLABORATION WITH MONOPOLY-CAPITALISM COLLUSION

i) Covid-19 vaccines are significant intervention in managing the pandemic, but should be based on an equitable distribution (Jomo, February 2021) and Big Pharma should not refuse to join the voluntary knowledge sharing and patent pooling COVID-19 Technology Access Pool (C-TAP) initiative under WHO auspices, (Chowdhury and Jomo, March 2021) because patents on vaccines were developed with public funding to the fight against COVID (Rob Wallace, The Political Economy of Pandemic).

Though the production of vaccines, like medicines, is an expensive process, and that the development of the scientific knowledge and production typically take time, whilst poorer countries need large volumes, the prices have to be affordable to them and easily available for everyone on mother earth.

Though governments, private companies, non-governmental organisations and COVAX, the vaccines pillar of the ACT-Accelerator partnership launched by the World Health Organization (WHO), Coalition for Epidemic Preparedness Innovations (CEPI) and Gavi, the Vaccine Alliance have funded the development of the Covid-19 vaccines, it is the monopoly-capital that benefits.

There are different prices for different vaccines in different countries as dictated by the Big Pharma

Indeed, pharmaceutical companies are charging different prices for different Covid-19 vaccines.

The Belgian budget state secretary’s tweet about the price list of the Covid-19 vaccines that her country intended to purchase from the European Union (EU) drew the ire of pharmaceutical companies. The tweet was deleted, but not before screenshots taken have put it in the public domain :

Johnson & Johnson: $8.50 (£6.30)

Sanofi/GSK: €7.56

Pfizer/BioNTech: €12

CureVac: €10

Moderna: US$18

The prices for the various Covid-19 vaccines even differ between those available in the United States (US) and European Union (EU) countries as summarised in The Washington Post of 18th. December 2020 :

Another extract from the British Broadcasting Corporation (BBC) is shown in the graph below :

ii) Many of those in the Global North signed agreements with Covid-19 vaccine manufacturers, and some made contributions to research and development and even made pre-payments like what Malaysia did, (The Star, 19th. November 2020). The unequal exchange since colonial conquest and imperial intrusion still is existing and persisting when doing business with the Big Pharma, even embroiling with a few unanswered questions of the royalty (Sarawak Report, June 2021) in intermediary exchange between nations, (Asia Sentinel, 9th. June 2021; Sarawak Report 11 June 2021); read also Ahmad Fauzi Abdul Hamid and Muhamad Takiyuddin Ismail The Monarchy in Malaysia: Struggling for Legitimacy, (kyotoreview issue 13).

Even WHO has to articulate “Vaccine pricing is becoming increasingly complex and multidimensional at a global level and in certain country contexts. Contracts now include elements such as assured volumes, upfront payment, multiyear contracts, bundling of products, discounts and rebates, etc. These conditions make it more difficult to identify the actual price of a vaccine and to disaggregate all price components.”

iii) Malaysia’s Vaccine Requirement

The currently available Covid-19 vaccines require two doses to be administered. As such, Malaysia, with a population of 32 million, would require 64 million doses.

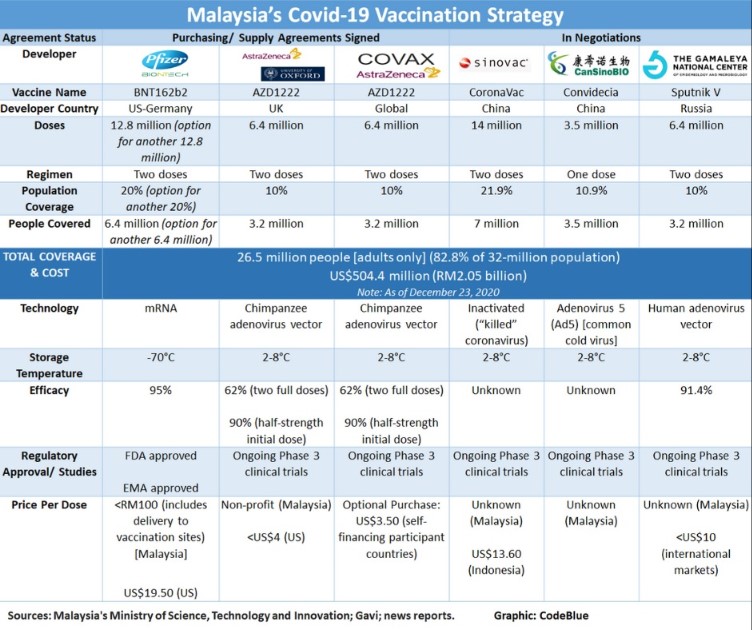

The Prime Minister has announced that the Covid-19 vaccine will be given free to all Malaysians. On 27 November 2020, the government announced that it will purchase 12.8 million doses of the Pfizer vaccine to vaccinate 6.4 million people. One million doses of the vaccine will be delivered in the first quarter, 1.7 million in the second, 5.8 million in the third and 4.3 million in the fourth quarter of 2021.

On 21 December 2020, the government signed an agreement with AstraZeneca to purchase 6.4 million doses of its vaccine to vaccinate 3.2 million people. The agreements announced to date would be sufficient to vaccinate 12.8 million Malaysians covering 40% of the population.

On 23 December 2020, the Minister of Science, Technology and Innovation announced that the government is also negotiating to buy 14 million and 3.5 million doses of the Sinovac and CanSino vaccines from China, respectively, and 6.4 million doses of the Sputnik V vaccine from Russia to cover another 11.95 Malaysians. With these additional purchases, up to 26.5 million people, that is, 82.8% of the population.

The government has also signed an Optional Purchase agreement with COVAX to provide vaccines for 10% of the population equivalent to 6.4 million doses for 3.2 million people. The ceiling price per dose has been set at US$10.55.

Based on the prices for the EU and the US, the Pfizer vaccine would cost the government between US$188.93 million to US$249.60 million, and the AstraZeneca vaccine between US$14.02 million and US$25.60 million. Based on the ceiling price, the COVAX vaccine would cost a maximum of US$67.52 million. The cost then to vaccinate 40% of the population would be between US$270.47 and US$342.72 million.

The published price per dose of the Sinovac vaccine ranges from US$13.60 to US$29.75 and the Sputnik V US$10. Indonesia will be getting the Sinovac vaccine at US$13.60. The price per dose of the Sinovac, CanSino and Sputnik V vaccines for Malaysia were not disclosed.

Further, reports of phase 3 trials of these vaccines are yet to appear in the scientific literature.

iv) Malaysia Vaccine Expenditure

The Finance Minister had informed Parliament that MYR3 billion (about US$750 million) has been allocated for Covid-19 vaccine procurement (Hansard 20201217). The government has stated that the targeted coverage of the population is 70%.

The Minister of Science, Technology and Innovation later tweeted that the vaccine expenditure on 22 December 2020 for 26.5 million Malaysians was ONLY US$504.4 million which was still US$250 million less than what was pronounced by the ruling bursary holder; another one billion ringgit blown with the monsoon rain.

Not stated was that in mid-November 2020, the country had paid upfront RM$94mil for vaccine under the Covax plan (The Star, 19th. November 2020).

The reason given for not disclosing the actual purchase price of all the vaccines ordered or acquired is that the Government of Malaysia has signed non-disclosure agreements (NDA) with the manufacturers and suppliers, presumbly including Pharmaniaga.

It is difficult to accept such simplistic rationality or justification as large sums of public monies are involved. When NDAs are signed that limits disclosure of information, about any procurement, it just raises suspicions of impropriety, and the certainty of an imminent collusion, if not close collaboration of clientele capitalism with Global North monopoly-capital is completed.

Agreements on vaccine procurement and pricing should be subject to external oversight of the Executive. This should be executed expeditiously by the Parliamentary Select Committee on Health, Science and Innovation as well as its Public Accounts Committee, and not presented as a fait accompli; see Sarawak Report 10th. June 2021, on chaotic rollouts.

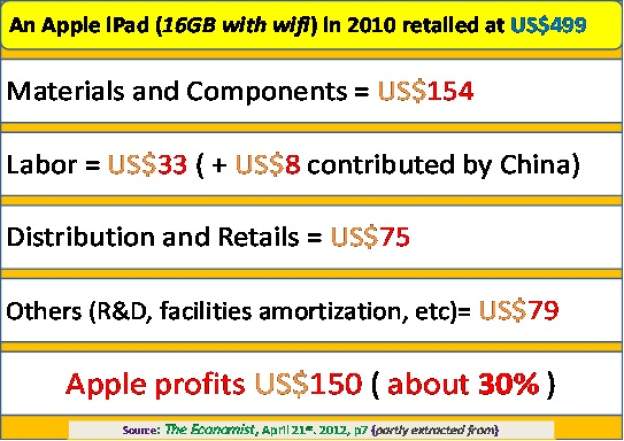

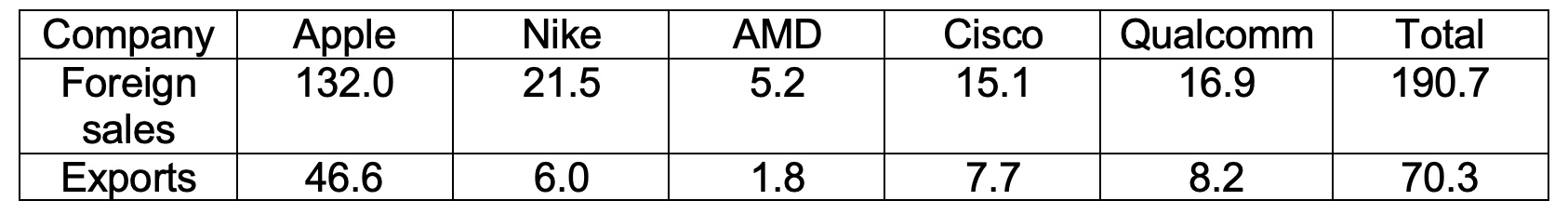

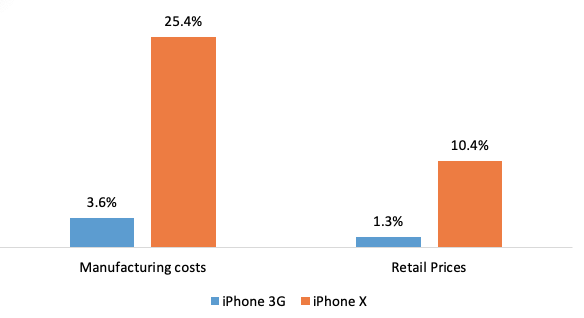

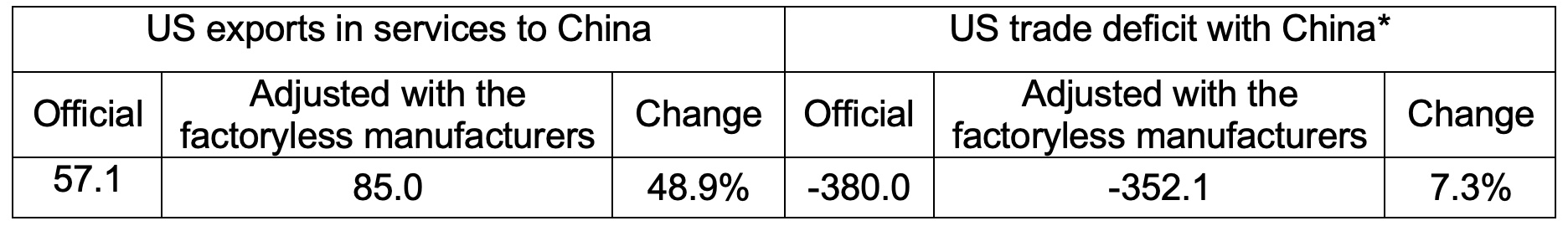

v) The fifth aspect is the Global North monopoly-capital domination in the supply and distribution of not only pharmaceutical products – and services – but other manufactured products throughout the global value chain where undue processes and procedures have caused intermediary commissions and offset costs to be incurred, (John Smith, The GDP Illusion, Monthly Review July 2012). The commodity value chain perpetuates the continuous unequal exchanges between monopoly-capital in Global North and the disadvantaged nations of the Global South, (see Intan Suwandi, Value Chains: The New Economic Imperialism, Monthly Review Press, 2019; John Smith, Imperialism in the Twenty-First Century: Globalization Super-Exploitation, and Capitalism’s Final Crisis, Monthly Review Press, January 2016).

5] CONCLUSION

The clientel capitalism is affecting our national healthcare services, and those profound issues regarding equity in healthcare provisions :

a) That the Big Pharma global pharmaceutical industry and the main corporate actors not only infrequently targetted country markets with unessential pharmaceutical products that they can sell for hundreds of thousands of dollars per year per patient linking to sales of the primary medicines is, indeed, a marketing strategy reality. A core concern is that the pharmaceutical companies have viewed the coronavirus pandemic as a once-in-a-lifetime business opportunity.

b) In the shadow of negative experience with monopoly capitalism during the HIV/AIDS pandemic when so many were ‘left to die’ (Nkegasong et al. 2020), Robinson and Gilbert 2018 have called for boethicists to engage with structural analysis to understand

how macro-economic structures intersect with medical research and practice by offering several illustrations of how twenty-first century capitalism intersects with COVID-19 to identify pathologies and opportunities for change going forward, (M.K. Robinson and J.M. Gilbert, Designing an Economic Bioethics, Harvard Law Policy, Oct.10, 2018).

In a paper entitled COVID-19 Impact and Mitigation Policies: A Didactic

Epidemiological-Macroeconomic Model Approach prepared by John P. Ansah, Natan Epstein, and Valeriu Nalban for the International Monetary Fund, November 2020, a workhorse framework is presented that combines a rich epidemiological model with an economic

block to shed light on the tradeoffs between saving lives and preserving economic outcomes under

various mitigation policies and scenarios calibrated for emerging market using Malaysia data as case country scenario with the reported epidemiological data gathered between late-January to early-July 2020 (source: Malaysia Ministry of Health).

Though the report came out with tractability, and the straightforward adaptation

to particular country-cases, implementation of relevant policies and scenarios (including endogenous lockdown stringency, second infection wave and temporary immunity considerations), and other tradeoff assessments, the compendium came out too late for mitigation implementation for the Sabah state elections in September 2020 that had by then introduced cross-border infection spreads into Sarawak and peninsula Malaysia.

The Sabah state election had resulted in an estimated 2,979 Covid-19 cases in the first few weeks after polling day, according to a new analysis reported.

This amounts to 70 percent of cases reported in the state from Sept 26 (polling day) until Oct 12 when the government began imposing the conditional movement control order in Sabah and several other states to curb the outbreak Prime Minister Muhyiddin Yassin admitted much later as such was the cause of the latest wave of Covid-19 infections across the nation, (malaysiakini 27th. May 2021).

The key element in the blueprint of action to mitigate this Covid-19 national emergency must surely be a well-executed Find, Test, Trace, Isolate and Support (FTTIS) system recommended by the World Health Organisation (WHO), which has fallen terribly short in its national implementation, (codeblue, 14th. January 2021).

The Bank Negara Malaysia Hotspot Identification Dynamic Engagement

(HIDE) model – introduced

in early May 2021, with the objective of trying to identify hidden or potential

hotspots, and taking preventive measures to

stop infections from spreading – somehow fumbled and neglected, (REFSA Projek Muhibah, June 2021).

c) IF the November 2020 IMF Didactic Model Report was consulted much earlier – when and where Malaysia is the applied country case-study – there would likely be no or minimal surge in the May 2021 national-wide cases of outbreaks linked to prayer gatherings and pre-Ramadan night markets and uncontrolled supermall shoppings, (New York Times, 27th May 2021). With ruling kleptocrates loosing a distinctive direction except to be on the trail of Covid vaccine shopping spree (Sarawak Report, 3rd. January 2021), where and whence clientel capitalism continues looting once again after more than six decades under Kleptocracy Governance and the country having indebted to more than RM$1.2+Trillion but, yet not completely clueless to confuse and crush the rakyat2.

EPILOGUE

Backdoor coup-mongers have a limited window of opportunity and fragility holding on power, except it’s time for clientel capital to pile up the private bank accounts now.

Related topics in STORM:

- Financialization of Healthcare – Capital and Health Equities

- Big Pharma

- Vaccine Distribution

- Underdeveloping Sabah Healthcare

- Sickness in Sarawak Healthcare

- Healthcare for All

You must be logged in to post a comment.