Collective on Geoeconomics

21st October 2023

1] INTRODUCTION

The current international tax system was designed to allocate taxes across countries, but the system is rife with misuse. Not only is there the profound issue on unequal exchange in a globalisation commodity trading environment, there is the leakages of a country’s revenue from transfer pricing during a manufacturing process, (see various articles related on this aspect here), and the stronghold – and correlated strugglehold – maintained and dominated by transnational corporations in their embedded intellectual property rights domain, (see Michael Perelman).

Companies have been gaming the international corporate tax system that had been designed to work in this manner:

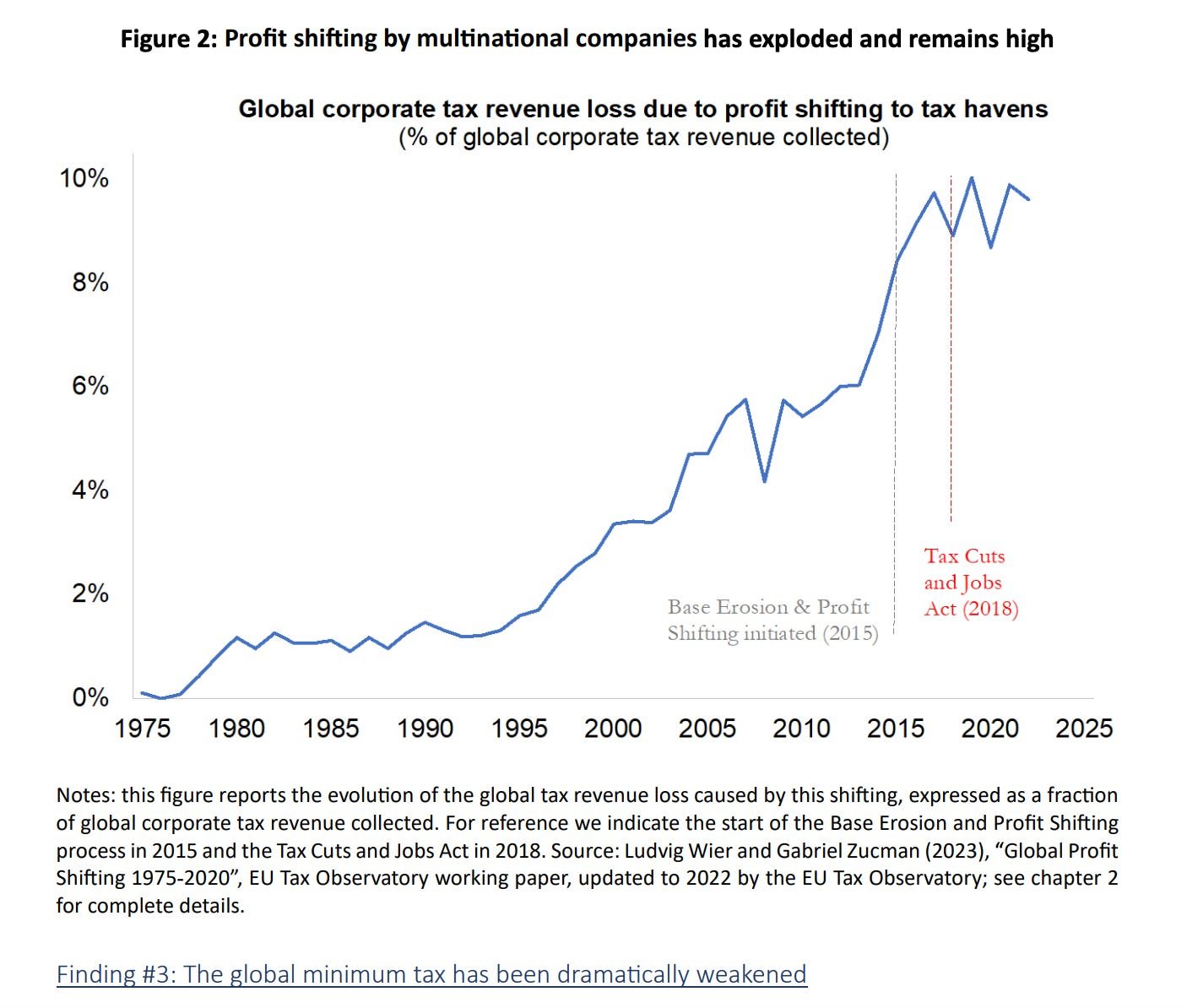

However, what we have been witnessing in the last quarter century is the evolution of monopoly capital into a more generalized and globalized system of monopoly-finance capital that lies at the core of the current economic system in the advanced capitalist economies — a key source of economic instability, and the basis of the current new imperialism, resulting in transnational corporations minimize their tax liabilities.

We present two articles – one by Jomo Sundram (in Third World Network, September 2023), articulating the attributes of international corporation tax, and the other piece on some inherent weaknesses within the monopoly financial capitalism domain.

II] International Tax Cooperation

After decades of resistance by rich nations, African governments successfully pushed for the United Nations to lead on international tax cooperation. All developing countries and fair-minded governments must rally behind this initiative.

UN LEADERSHIP

The official UN Secretary-General’s Report (SGR) was mandated by a UN General Assembly resolution, unusually adopted by consensus in late 2022.

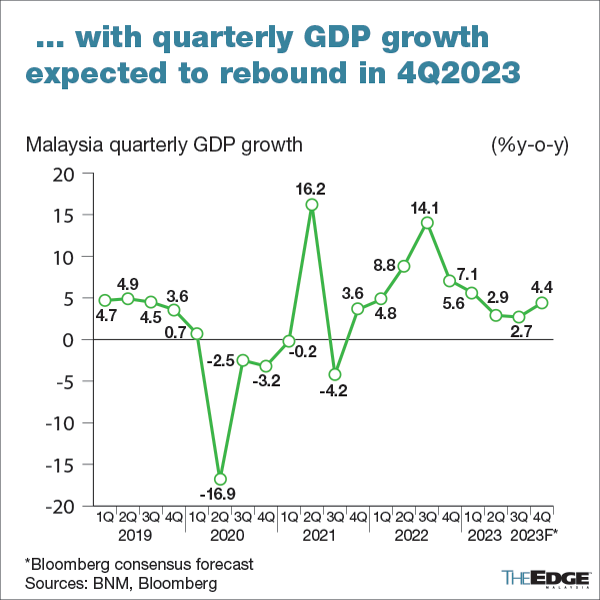

All countries must now work to ensure progress on financing to achieve the Sustainable Development Goals (SDGs) and climate justice after major setbacks due to the pandemic, war and illegal sanctions.

Rich countries had blocked an earlier tax cooperation initiative at the Addis Ababa Financing for Development (FfD) summit in mid-2015.

With grossly inadequate funding, the SDGs were condemned to a still birth.The SGR on options to strengthen international tax cooperation is, arguably, the most important recent proposal – remarkably, from a beleaguered and much ignored UN – to enhance FfD for SDG progress. It proposes three options: a multilateral tax convention, an international tax cooperation framework convention, and an international tax cooperation framework.

The first two would be legally binding, while the third would be voluntary in nature.

EURODAD PROPOSAL

In response, the European Network on Debt and Development (Eurodad) has made a proposal – supported by the Global Alliance for Tax Justice (GATJ) – noting: “It is time for governments to deliver … [and] … cooperate internationally to put an end to tax havens and ensure that tax systems become fair and effective. “International tax dodging is costing public budgets hundreds of billions of Euros in lost tax income every year, and we need an urgent, ambitious and truly international response to stop this devastating problem. “We believe the right instrument for the job is a UN Framework Convention on International Tax Cooperation and we call on all governments to support this option…“For the last half century, the OECD has been leading the international decision-making on international tax rules and the result is an international tax system that is deeply ineffective, complex and full of loopholes, as well as biased in the interest of richer countries and tax havens.“Furthermore, the OECD process has never been international. Developing countries have not been able to participate on an equal footing, and the negotiations have been deeply opaque and closed to the public.“We need international tax negotiations to be transparent, fair and led by a body where all countries participate as equals. The UN is the only place that can deliver that.”

A BIG STEP FORWARD?

Strengthening international tax cooperation is expected to be the major issue at the one-day UN High-level FfD Dialogue on 20 September 2023. A UN resolution on international tax cooperation – for General Assembly debate after September 2023 – should plan a UN-led intergovernmental process. After all, developing such solutions is a key purpose of the multilateral UN.The Africa Group at the UN had appealed for a Convention on Tax in 2019, to help curb illicit financial outflows. After all, such tax-related flows are international problems, requiring multilateral solutions.

International tax cooperation should be inclusive, effective and fair.

The EURODAD-GATJ proposals deserve consideration by all Member States negotiating a UN tax convention. The outcome should include:

* Create an inclusive international tax body. The Convention should create international tax governance arrangements, using a Conference of Parties (CoP) approach, with all countries participating as equals. Currently, international tax rules are decided in various bodies where developing countries never participate as equals.

* Enable an incremental approach to achieve other intergovernmental agreements. The outcome should be a framework convention, with basic structures, commitments and agreements enabling further updating and improvements later.

* Incorporate developing countries’ interests, concerns and needs to achieve tax justice. The Convention should address developing countries’ interests, concerns and needs, replacing current tax standards and rules favouring wealthier nations.

* Enhance international coherence. The Convention should develop a coherent system for all nations, including developing countries. It should eventually replace the plethora of existing bilateral and plurilateral tax treaties and agreements with a coherent overall framework. This should improve effectiveness and cut tax dodging.

* Strengthen international efforts against illicit financial flows, especially involving tax avoidance and evasion, with simpler, more coherent and straightforward rules and standards to improve transparency and cooperation among governments.

* Eliminate transfer pricing. The Convention should eliminate transfer pricing by replacing existing rules enabling such abusive practices.

* Tax transnational corporations globally. Transnational corporations’ consolidated profits should be taxed on a global basis. Tax revenue should be distributed among governments with a minimum effective corporate income tax rate based on a fair and principled agreed formula recognizing developing countries’ contributions as producers.

* End coerced acceptance of biased dispute resolution processes. The Convention should not require countries to accept biased processes, such as binding arbitration, favouring those who can afford costly legal resources.Effective dispute prevention would reduce the need for dispute resolution. Alternative mechanisms for resolving disputes could also be negotiated – using inclusive and transparent decision-making processes – under the Convention.

* Enhance sustainable development and justice. The Convention should promote progressive taxation at national and international levels. It should ensure improved international tax governance and support government commitments and duties, especially relating to the UN Charter and Sustainable Development Goals.

* Improve government accountability. The Convention should ensure transparent and participatory tax decision- making, with governments held accountable to national publics.

* Ensure transparency. The Eurodad proposal emphasizes the “ABC of tax transparency”, i.e., Automatic Information Exchange, Beneficial Ownership Transparency, and Country-by-Country reporting.Actual progress will not come easily, especially after the strong-arm tactics – used by the G-7 group of the biggest rich economies and the Organization for Economic Cooperation and Development (OECD) – to impose its tax proposals at the expense of developing countries.

In brief, though there are transparency advocates who have long supported an overhaul of the international tax system, including greater representation for lower-income countries, however, in a statement, Tove Maria Ryding of the European Network on Debt and Development described the OECD as a “rich countries’ club” where decisions are made behind closed doors.

“If the EU countries don’t revise their position, they risk becoming blockers in the global fight against tax havens,” Ryding said; to read more here.

III] The Limitations

Though there is a real chance for international tax cooperation, in September 2023, a group of EU finance ministers warned the U.N. tax convention would risk duplicating OECD-led efforts to curb cross-border tax dodging, (icij, October 2023).

“This would be time consuming for all jurisdictions,” the finance ministers said in a joint letter. Instead, they called for a globally inclusive discussion forum without binding legal powers, which would act in parallel to the OECD’s role; but, then, the OECD is a “rich countries’ club”.

Other still existing constraints:

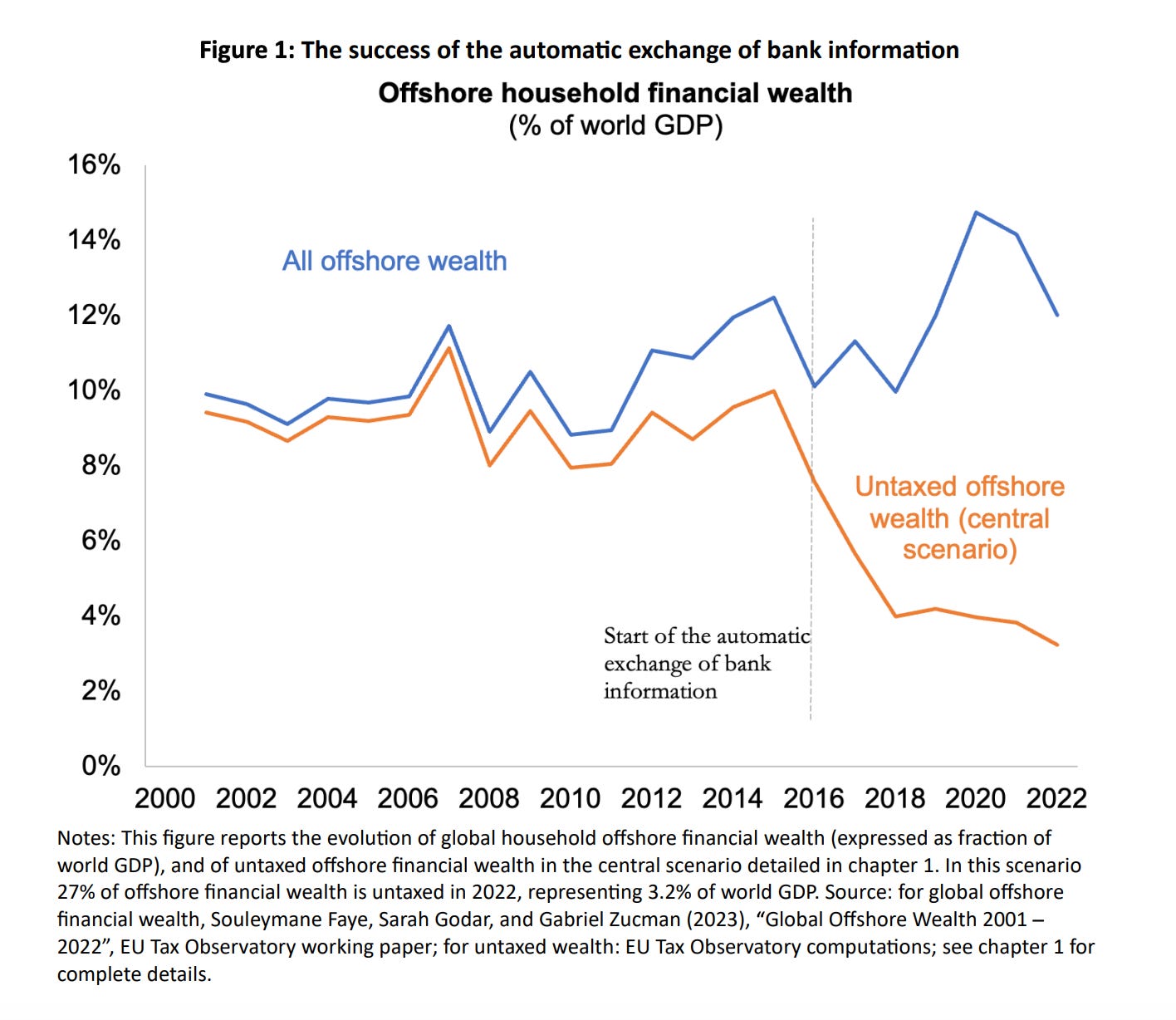

First, offshore tax evasion by wealthy individuals has shrunk. Thanks to the automatic exchange of bank information, we estimate that offshore tax evasion has declined by a factor of about three over the last 10 years. This success shows that rapid progress can be made against tax evasion if there is the political will to do so.

Third, tax evasion – including grey-zone evasion at the border of legality – is increasingly happening domestically. Global billionaires have effective tax rates equivalent to 0% to 0.5% of their wealth, due to the frequent use of shell companies to avoid income taxation. To date no serious attempt has been made to address this situation, which risks undermining the social acceptability of existing tax systems.

We make six proposals to address the issues identified in this report. A key proposal is to institute a global minimum tax on billionaires, equal to 2% of their wealth. We provide a first estimation of the revenue potential of this measure, showing that it would raise close to US$250 billion (from less than 3,000 individuals) annually. A strengthened global minimum tax on multinational companies, free of loopholes, would raise an additional US$250 billion per year. To give a sense of the magnitudes involved, recent studies estimate that developing countries need US$500 billion annually in additional public revenue to address the challenges of climate change – needs that could thus be fully addressed by the two main reforms we propose.

Source:

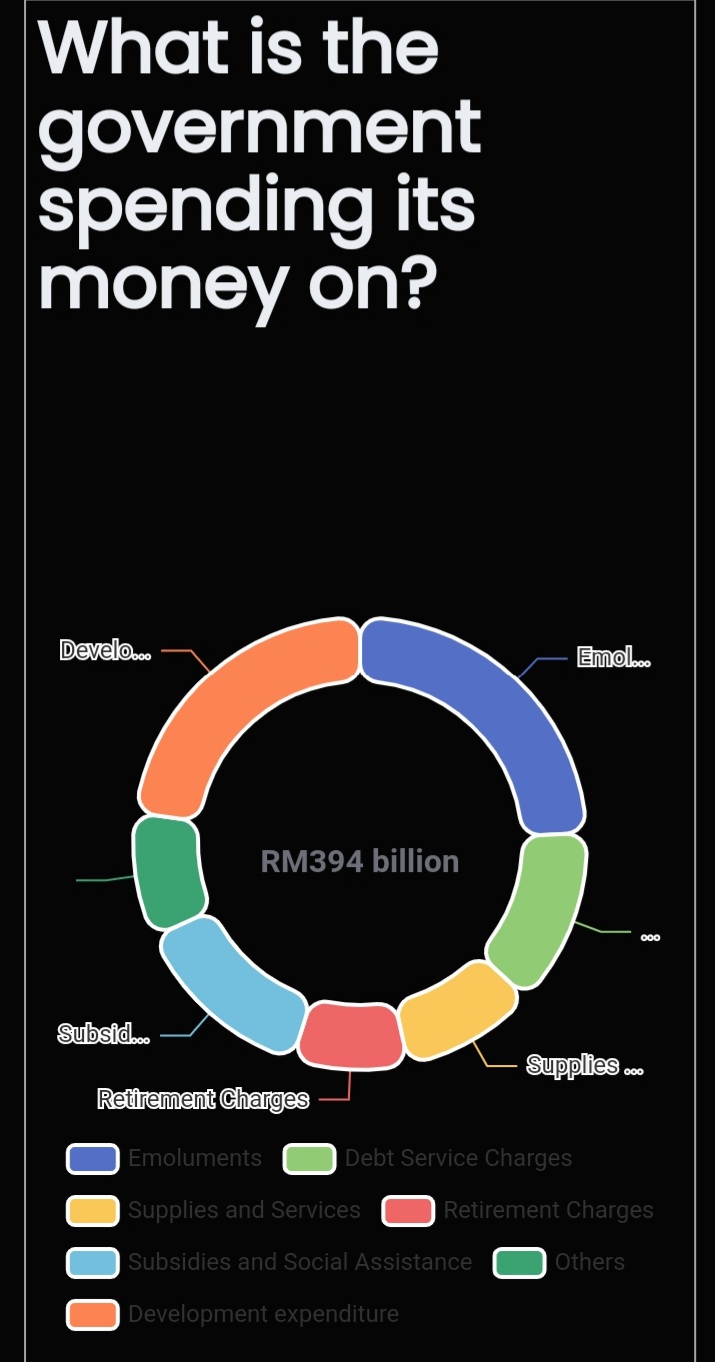

Thus, after gaining political independence, the economic state of a nation is still being dominated (45%) by foreign-owned enterprise;

Thus, after gaining political independence, the economic state of a nation is still being dominated (45%) by foreign-owned enterprise;