PROLOGUE

Between the dominating and the dominated, under capitalism the capitalists

are dominant at each level in place, position and power whereas the proletarian workers are dominated at such each level.

1. INTRODUCTION

Looking at the social processes, one shall find the basis of social classes in the relations of production in the economy. Those who own and control the means of production, and who are able to take ownership of all that is produced, form the ruling class.

Those who sell their labour power to the owners of the means of production are the proletariat or working class. Instead of class as a characteristic of individuals, the way classes act in society should be seen as collective actors. That struggle between classes – between capital owner and labouring producers – is the defined essence of history driving all social change.

Classes are rooted in the common material interests that derive from a similar relationship to the means of production. However, that is not enough to unite or empower a class. To be a class “for itself” as well as “in itself,” a class needs a “community, … national bond, and … political organization,” as Marx said in The Eighteenth Brumaire of Napoleon Bonaparte.

The class positions of the capitalist fundamental class processes are productive workers (performers) and productive capitalists (extractors). Capitalists appropriate surplus value from the consumption of labour power during the production of commodities. The surplus is distributed among occupants of subsumed class positions associated with the state, merchants, financiers, landlords, managers and monopolies.

A class’s real power, over and above the sum of its members, is derived not just from common material interests, but from the class’s awareness of itself as a class engaged in struggle with other classes. In a sense, that class consciousness was what empowered the industrialists of the eighteenth and nineteenth centuries to defeat the landed aristocracy in Europe, and it will be what empowers the worker-proletariat to defeat the compradore capitalist ruling class presently.

2. THE DOMINATED CLASS

In the 21st. century, the working class includes industrial workers in transnational corporations as well as local small manufacturing enterprises (SMEs), share-riding drivers, hospital nurses and aides, baristas, warehouse workers, forwarders package handlers, teachers, engineers, research scientists, and I.T. people —alongside factory, construction and plantation workers and other incarcerated labour.

Small business owners – the petty bourgeoisie – is seen as a “middle” class, torn in their loyalty to the working class, which is closest to it in material conditions, or to the ruling class, to which it improbably aspires. Owners of small businesses and independent professionals may employ a handful of individual workers, whom they exploit by appropriating the surplus value of their labour in the same way that big corporations exploit workers.

At a time of post-pandemic more than ever, the working class is being squeezed financially where the costs of food, housing, health care and transportation are consuming ever larger shares of household budgets, and have risen faster than incomes even among the urban poors.

As an instance, the SME is still powerless compared to transnational and government-linked Big Business. Like the working class, it is vulnerable to the vagaries of the capitalist economy with its boom and bust phases. Small business owners are definitely hit hard in the current situation. About 15 per cent of micro, small, and medium-sized enterprises (MSME) are temporarily closed due to a lack of funds stemming from the pandemic, The Malaysian Insight reported in 4 Jan 2022.

According to the SME Association president, Ding Hong Sing, there are 1.15 million SMEs, which account for 97.2 per cent of businesses in Malaysia. Eighty per cent of them are in the service industry, and in 2020, this figure increased to 85.5 per cent. In 2019, SMEs contributed to 38.9 per cent or RM$553.5 billion of the GDP but this declined in 2020 to 38.2 per cent or RM$512.8 billion.

Also in terms of employment, SMEs are also hiring 48 per cent less. In 2020, SMEs employed 7.24 million people, 0.9 per cent less than the previous year, when they employed 7.32 million people.

The year-on-year decline shows SMEs have been definitely severely hit by the coronavirus Covid-19. Before 2020, the number of people employed increased by at least 3% or 200,000 a year. Add on to the employment profile is that any graduate entering into this sector often shall earn only RM$2,500/month (or even RM$2,100 according to JobStreet), barely a living wage working in urban towns.

3. THE LANDED CLASS

There is an established cadaster (an official register of the quantity, value, and ownership of real estate used in apportioning taxes) and a land registration system in the country.

With this system, however, the processes enable provision of land administration services to the property ruling class that with financialization capitalism in place with the Real Estate Investment Trust (REIT), has inadvertibly displaced the working class rakyat2 from an essential settled accommodation . The gap between wages and house prices in the country has steadily widened, too, and the ensuing urban poverty therein.

The UNICEF 2020 Report has shown that low income female-headed households are exceptionally vulnerable, with higher rates of unemployment at 32% compared to the total heads of households. Female headed households also registered lower rates of access to social protection, with 57% having no access compared to 52% of total heads of households.

The concurrent issue is the commodification of housing which constitutes the major barrier to its equitable distribution, with construction and allocation determined not by social need but by the accumulation of capital by real estate developers in the financialization in capitalism.

The Department of Statistics Malaysia (DOSM) had released figures to show that the average monthly salary and wage received by workers in the country was RM3,224 in 2019; a typical apartment in the Klang Valley is one hundred times say on this basic monthly salary. Presently, there is a total of about 10 million salary and wage recipients in Malaysia. The Household Income & Basic Amenities Survey Report 2019 by DOSM showed that the country’s 2019 median income of a household of four is RM5,873. This means it is sixty times of both parents’ monthly salaries to get a decent shelter.

Between 2010 and 2019, in the country, the average y-o-y height of increase in house prices was 7.9% surpassing income’s increment of only 5.6%.

Affordability was aggravated by the property hype during the 2010-to-2014 period, when property prices rose double digits annually — and peaked at 13.2% in 2012. The average annual appreciation for the 2012-to-2014 period was 11.2%. By 2021, the national median house price had increased by five per cent to RM 310,000. This represents a 96.2 per cent increase over the RM158,000 recorded in 2010.

According to Emir Research, it will take an average of 44 years to repay a housing mortage installment of a property valued at RM$400,000, (theSun, 15/08/2022). Further, according to the Bank Negara’s Financial Stability Review for the second half of 2021, only 35.6% of newly launched housing units since 2015 are priced below RM$300,000 whereas 76% of households earn less than the minimum RM$8333 a month to afford houses above this price. In fact, property prices have doubled every 10 years that account for a 400% increase every 20 years.

The real estate developers, consortium of property-speculators (including China-based real estate developers in Forest City and Princess Cove, Johore), REIT owners (like IGB REIT and Pavilion REIT) have cornered the property segment, through financialization capitalism, to entrench the landed class. It comes at a time when wages are stagnated over the years while house prices have surged forward. Indeed, the compound annual rate of growth for incomes and house prices (just during the 2014-2020 period) has increased disproportionally 2.1% and 4.1%, respectively.

Through the years, the wages and salaries of Malaysian workers had grew less than 1%, or about RM17 in real terms, Bank Negara Malaysia data had shown. Even with a 4.2% GDP growth rate, it is belied by persistent joblessness which rose to 13% of employment in 2016, according to the central bank, not taking into account the larger segment of unrecorded underemployment.

These sobering realities pose another enormous challenge to rakyat2 enduring class struggle as their savings rate of 1.4% in 2013 is really razor-thin as reported by a Khazanah Research Institute (KRI) study in 2016, even at a time when there are (US$ 4.41 billion) unsold apartments in Malaysia’s major cities then.

Dr Mahathir once said that Malaysia today is not owned by the Bumiputeras because many Malays remain poor and they tend to sell their land – to the property class of real estate developers, including monopoly-capital TNCs, and REIT financial capitalists who are able to invest in quality large-scale commercial real estate without having to buy the properties directly and even at a lower price.

A solution to the wealthy rich holding on their landed properties is to address the housing needs of the impacted apart from the continued construction of houses that are far beyond the means of the average Malaysian working class, particularly the B40s through a rental model, (REFSA August 2022).

Applying Engels thesis, present real estate reality has little to do with a lack of housing stock, but instead, it is firmly rooted in the mode of capitalism itself, and the exploitation upon which the system hinged.

4. THE WEALTHY RICH

On April 29, 2022, it was reported that Fernandes – the CEO of Capital A, formerly known as AirAsia Group Bhd – received RM14,947,213 in addition to RM124,781 in allowances for meetings, travel and other matters. Kamarudin, the executive chairman of Capital A, meanwhile received RM14,051,429.

Takaful Malaysia CEO Mohamed Hassan Kamil’s income was equivalent to RM903,000 a month or RM10.84 million a year.

The chairman of BIMB Holdings earns RM375,000, while other Board members earn between RM375,000 and RM768,000 a year.

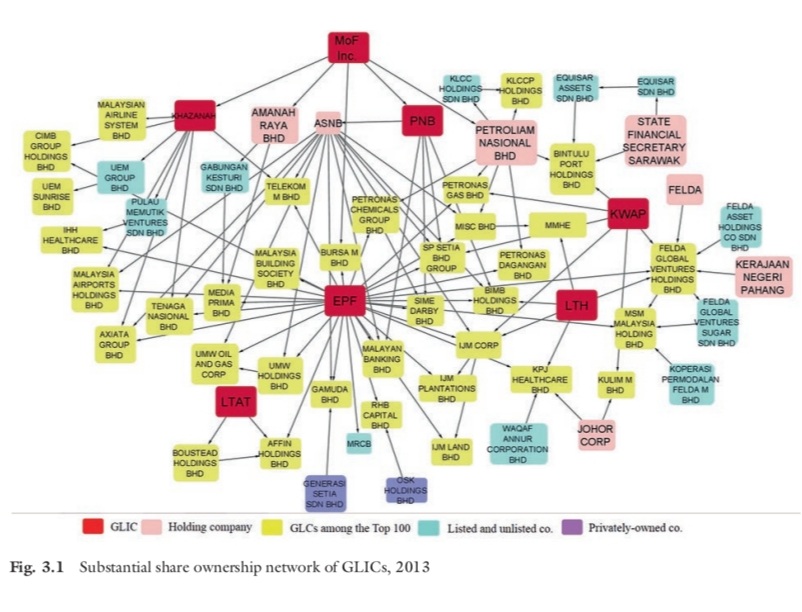

This thrust in the social hierarchy from a class of clientel capitalists is only reinforcing capitalism as the economic development agenda, and financialization capitalism as pathway in the country towards the widening accumulation of capital. The ensuing profit generated in companies, and the rent elements received by oligarchy individuals, inevitably perpetuate the extraction of outsized surplus values relative to capital “invested”.

From the British forward movement in colonialism to our present sluggish ruling regimes, capitalism is to insert clientel-capitalism to colonialise the minds of the unrepresented destitutes. It is to retain and sustain political power, immiserising countless land-settleless rakyat2 and urban destitutes. The capitalism in crisis would continue impoverishing the poors in order for capitalism, specifically ethnocapital clientel capitalism – with the political fabrication and construction that had rapidly metamorphosed into policy constructs in the 1970s (Lim Teck Ghee) ensuing as an economic entrenchment of the NEP construct (Woo 2015, James Chin 2016, KBN 2018, Khalid 2019, KRI 2020, Kua 2021 & Diam 2021) which clearly is divisive to the nation’s unity and sense of belonging – to exist and flourish. Often, the guided narrative is spritzered with the particular Sudhave’s burden of privilege under a clientele capitalism downpour.

Compounded by serial corruptive practices through the decades – from Perwaja to 1MDB – the wealthy rich has siphoned off national wealth to foreign countries: see the Panama Papers and Pandora Papers; specifically on Diam’s and Jho Low’s captured wealth. Sarawak Report has also recently revealed that a story slipped out in Switzerland has exposed how Malaysia’s coup coalition of present ruling regime had not only been negotiating to drop charges against Jho Low, but in return for RM$1.5 bn in cash, too.

5. THE POVERTY POORS

According to an Employees Provident Fund (EPF) annual report, the salary of the CEO and his deputies reached RM6.1 million a year or an average of almost RM130,000 per person or RM4,300 a day. Compared to their salaries with the 1 in 5 EPF contributors who have a savings of just RM7,000 in his/her account.

CEO at Sime Darby Plantations (SDP) his annual income was almost RM8 million a year. His income from being CEO there from 2011 to 2017 was RM64 million!

As an example, basing on a transnational corporation’s (TNC) food delivery service being paid RM$5 per hour and the minimum RM$3 per order, with 240 hours of work a month, a gig-rider woul get RM$1,200. If the person makes 260 deliveries, he/she will earn RM$780. The total gross earnings for the month would be RM$1980; in the Federal capital of Kuala Lumpur, a single person estimated monthly costs-of-living is RM$2,106 without rent!

In 2020, the Department of Statistics Malaysia (DOSM) indicated that there were almost four million people working in the gig economy in Malaysia; independent think-tank, Emir Research, confirmed about 26% of the Malaysian labour force were full-time gig workers, reaching 30% by 2021.

Data from the eKasih system indicated that as of July 31, 136,923 households were in the extreme poor category, while 308,699 were categorised as poor. However, the effects of the Covid-19 pandemic – which saw clientel capitalism colliding with the crisis – had caused the rate of absolute poverty to increase to 8.4% and extreme poverty to 1% in 2020 while generating 5 billionaires within a year and benefitting the Big Pharma. Also, to be reminded that the country’s relative poverty rate stood at 16.2% in 2020 which is high for a country “developing” since 1960s under a suite of neoliberalism-is-neoimperialism-regime.

Consequently, the top 20% of population – the T20 – possess 46.2% of the national income share, while M40 have 37.4% of the national income share but the bottom 40% of population – the B40 – only get 16.4% of the national income share of wealth (see also Khalid, 2019).

By the end of the 23-year first regime rule of prime minister Mahathir Mohamad, it was clear that the UMNO-led effort to build a Malay capitalist class had helped sanctify and institutionalise a system of cronyism where natural resource wealth, including oil and gas, was professionally stewarded and whence a decade of muscular redistribution went to the country’s ethnocapital Malay minority, through a process from colonial racial colonialism to clientel ethnocapital colonialism.

EPILOGUE

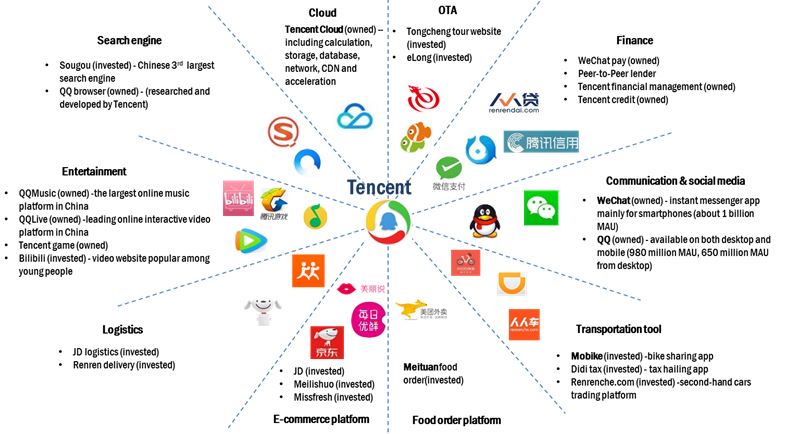

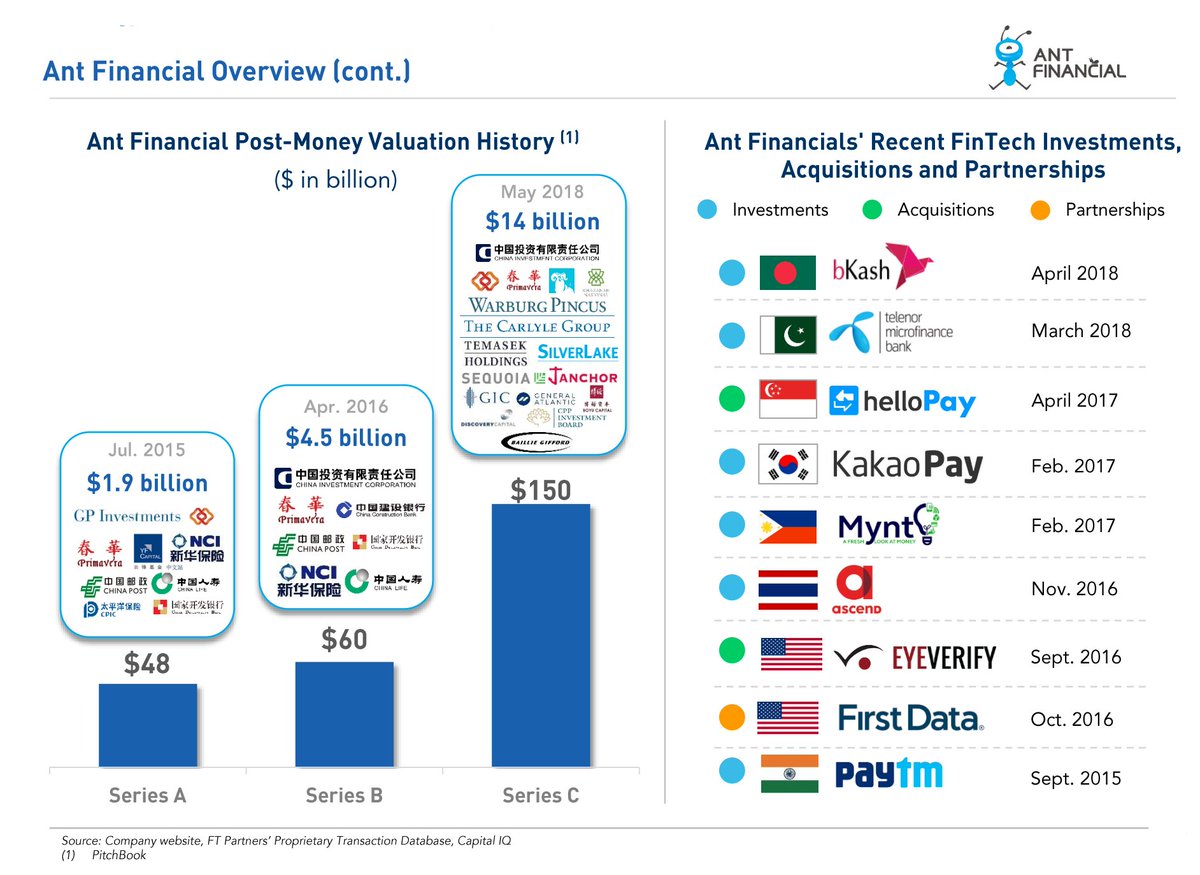

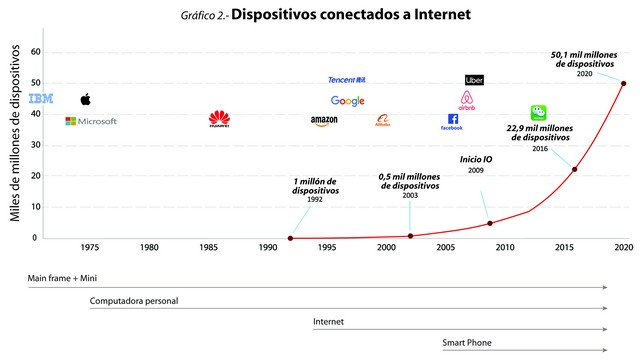

The rentier capitalism ecosystem is dominated by a few wealthy companies and individuals with amble access to key scarce assets (such as land, natural resources, financial means, licences, intellectual properties and digital platforms) and, in doing so, capturing and looting these resource and siphoning national wealth abroad without due societal care nor contributions to rakyat2 wholesome socio-economic wellbeing.

-¤¤¤-