1 INTRODUCTION

As per Yanis Varoufakis, “Capitalism has morphed itself into what I call Techno Feudalism.” There exists in techno-feudalism the modern version in the formation, and foundation, of infrastructural platforms which have :

• Sheer Computing Power

• Unprecedented Concentration of Economic Power in a few private hands

• Ability of tech-aristocracy to shape the society

It comes at a time when printed money has replaced private profit as the driver of economies, and markets are giving way to platform-based fiefdoms.

Digital infrastructural platforms are not unlike colonial ‘forward movement’ activities where lands are waiting to be discovered and conquered. Whoever gets there first, and holds fast and tight, shall get their information server-riches. The infrastructural platform kings (colonial-feudal lords) positions themselves above users (the colonised), and their data surfing activities (serfs’ farm cultivation), thereby giving them overwhelming privileged access (lordship) to record and retrieve (dictate and dominate) endusers (the serfs) as and when demanded (as surplus value expropriation) under an information-commodity chained monopoly-capital environment (via routers and cloud servers) .

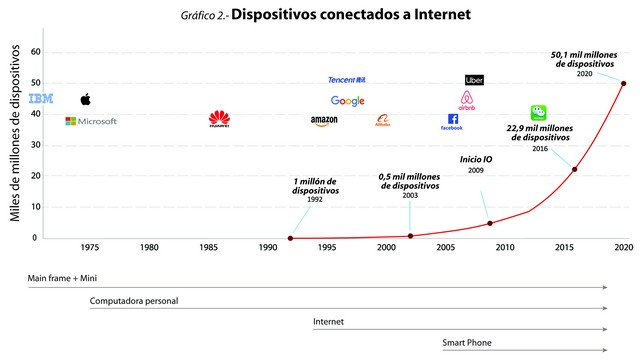

To gain, and accumulate, capital on behalf of the infrastructural platform kingdoms are the telecommunication intermediary knights riding on their Internet of Things to provide, partition and protect, information services to their surfing serfs. It is the emergence of a new business model of large monopolistic firms on digital platforms that are capable of extracting immense amounts of data overwhelming legacy enterprises and suppressing labour empowerment, (Paul Langley and Andrew Leyshon, Platform capitalism: The intermediation and capitalisation of digital economic circulation, 2020).

Some named this as “netarchical capitalism” , where infrastructure is “in the hands of centralized privately owned platforms”, (Nick Srnicek, Platform Capitalism, 2017).

2 CAPITALISM ARISING

- Like the old feudal class, the new tech aristocracy is constantly engaged in a turf war. They wish to capture more digital real estate and augment its control over the data and emerging technologies like AI.

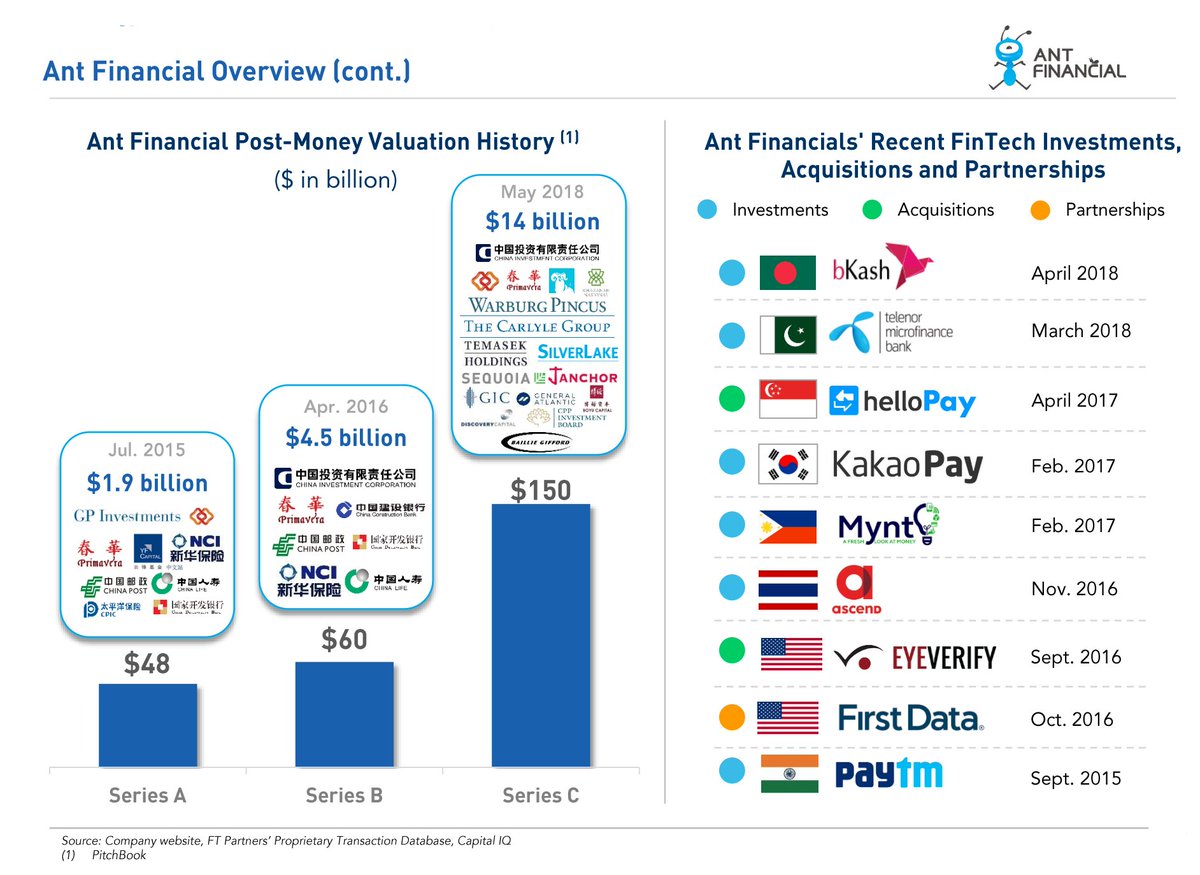

- The big tech companies – acting like the Dutch East India company in exercising monopoly – are IT aristocrats reshaping society:

i) Digital technology has already transformed the world economy; the decade leading up to 2019, the largest 100 firms in the world had increased their total market capitalisation by US$12.7 trillion. A third of that increase (US$4.2 trillion) can be said to be accounted for by just seven firms: Facebook, Amazon, Apple, Alphabet, Microsoft (the famous quintet ‘FAAAM’), Alibaba, and Tencent as enabled and enhanced by digital technologies:

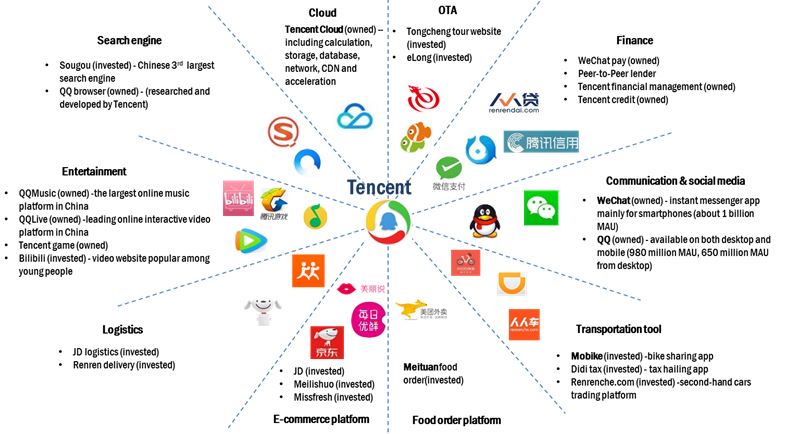

ii) A view of Google ecosystem shall give a better understanding of the wide breadth in span, spectrum and specialities of its activities in the digital marketsphere:

Other examples like Amazon’s marketplace or Apple’s Appstore cannot be treated as mere market players – instead, they are creating, and controlling, the entire marketspace: deciding which and when producers and consumers can access their respective markets, on what conditions, and – via algorithms – how the market operates. To be noted, too, is that new online business models like Facebook and Instagram increasingly merge social and commercial activity – and this trend is accelerating, (see Anreesen Horiwitz (2020), Social Strikes Back).

Other facts shall show that Google has some 90 per cent of the market for Internet searches. Facebook accounts for two thirds of the global social media market, and is the top social media platform in more than 90 per cent of the world’s economies. Amazon boasts an almost 40 per cent share of the world’s online retail activity, and its Amazon Web Services accounts for a similar share of the global cloud infrastructure services market. In China, WeChat (owned by Tencent) has more than one billion active users and, together with Alipay (Alibaba), its payment solution has captured virtually the entire Chinese market for mobile payments; Alibaba estimated to have close to 60 per cent of the Chinese e-commerce market.

iii) With ongoing surge in demand for infrastructural platforms’ services, now and in the near future, this means that cloud-based services across the world, and in SE Asia region in particular, are expanding, too. This demand for Big Data storage, massive processing and critical risk management of installed systems has prompted big corporates such as Google, Alibaba Group, Amazon Web Services (AWS) to expand their cloud infrastructure footprint widely in Malaysia during the last few years, (ChannelAsia 08 October, 2018; Nikkei 04 May, 2019; The Star 09 June, 2020).

iv) Some of the input to the local Digital Infrastructure or DI is the physical medium, the infrastructure through which the traffic generated by the internet flows. This includes everything from telephone wires, cables (including optic fiber and submarine cables) to microwaves, satellites, and mobile technology such as fifth-generation (5G) mobile networks, IoT, and servers as well. On the server-side, major companies like Amazon or Microsoft stepped in to build and provide this growing digital infrastructure known as “the cloud”. Besides cables, cloud, and other things mentioned above, the data centers (hardware and software) and their administration is also a part of wide digital infrastructure work.

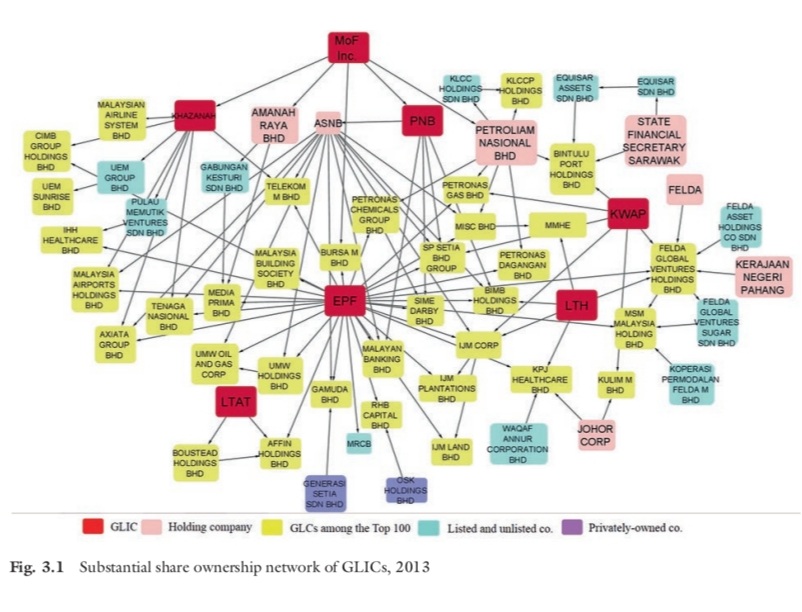

v) There is a growing centralisation of political and economic power in the Office of the Prime Minister and the Minister of Finance with a confluence of influence of the state over the GLCs that have the concentration of capital and accumulation of capital as Gomez laid out in Minister of Finance Incorporated: Ownership and Control of Corporate Malaysia, and more importantly, by offering higher dividend returns, cooperating closely with those local corporate capital that have connections to Global North monopoly-capitalists and by internationalising their operations, they successfully link up electrical and electronic small manufacturing enterprises (SME) with products assembly, supplies and logistics competitiveness into the Global North supply chains.

3 CAPITALISM ENCROACHMENT

The big tech companies can disobey the sovereign and tax laws, and as such are reshaping society:

Firstly, the Intellectual Property Rights (IPR) is a monopoly regime. Intellectual property includes product design, brand names, and symbols and images used in marketing. These are protected by rules and laws covering patents, copyrights, and trademarks. Figures from the UN Conference on Trade and Development show that royalties and licensing fees paid to multinational corporations increased from $31 billion in 1990 to $333 billion in 2017, (United Nations Conference on Trade and Development, World Investment Report 2018).

According to figures from Science and Engineering Indicators 2018 Digest, released by the National Science Council of America in January 2018, the total global cross-border licensing income from intellectual property in 2016 was $272 billion. The United States was the largest exporter of intellectual property, with income from this source comprising as much as 45 percent of the global total.

With the TRIPs/WTO (Agreement on Trade-Related Aspects of Intellectual Property Rights) as an international legal agreement between all the member nations of the World Trade Organization), the intellectual property regime has only strengthened, (Cédric Durand, William Milberg, Intellectual Monopoly in Global Value Chains, 2018).

Through the ownership and control of information, monopoly-capital dominates the digital capital, too. Capital accumulation permeates the entire production chain but through soft elements in the ownership of patents, copyrights, brands and logistical systems impoverishing the poors but enrich the bourgeoisie class by way of financialization capitalism.

Secondly, the tech-venture capital bloc’s reducing capital gains taxes in 1978 from 50% to 28% became known as the Silicon Valley model, now emulated much all over the world (Marxist Sociology April 2021).

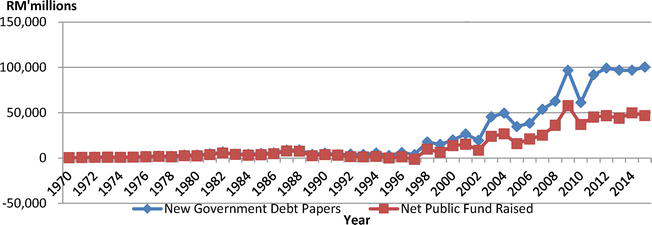

Thirdly, without promulgated regulations, financial monopoly capital is very likely to work against the vision and goals set by country for her industrialisation initiatives. The insurgent of capital financialization in the late 1990s had already created an increased circulation of paper instruments and their associated debts :

4 CAPITALISM MORPHS

According to Varoufakis, the eclipse of capitalism as we know it is embedded visibly for a while. Bond and share prices, which should be moving in sharply opposite directions, have been skyrocketing in unison, occasionally falling but always in lockstep. Similarly, the cost of capital (the return demanded to own a security) should be falling with volatility; instead, it has been rising as future returns become more uncertain.

Perhaps the clearest sign that something serious is afoot appeared on August 12 2020. On that day, we learnt that in the first seven months of 2020, the United Kingdom’s national income had tanked by more than 20 per cent, well above even the direst predictions. A few minutes later, the London Stock Exchange jumped by more than 2 per cent. Nothing comparable had ever occurred. It looked like finance had become fully decoupled from the real economy.

Similarly, the Malaysian market during the covid-19 pandemic had been active. As at end-December 2020, the domestic bond market was valued at RM$1. 61 trillion, translating into about 46.9% of the nation’s overall capital market (RM$3. 43 trillion).

Like in the UK market pattern, similarities occured where the returns to foreign investors’ holdings in the local bourse was 13% at the end of this period according to MoF’s report.

Over a nine-month period between the end of 2020 to end-September 2021, the market capitalisation, however, rose by 10% to RM$1.80 trillion, while the market transacted over 1.20 trillion shares worth RM$729.2 billion.

In terms of market velocity, the market registered 54%, while the market volatility was 9.1%.

Concurrent with this trend there was a surge in online share-tradings where with bountiful of revenue-generated profits, a company like Top Glove Corp Bhd was then evaluating for dual primary listing on the Hong Kong Stock Exchange (HKEx), in consideration of raising more than US$1 billion from the listing exercise.

Knight Frank consultancy firm at this moment of digital time had estimated that Malaysia capital accumulation of wealth-creation is the 10th fastest in the world – with the mean income of RM$7,901 in 2019 – the 2020 wealth report projected that the number of Malaysians with more than US$30 million will swell by 35 per cent between 2019 and 2024, compared with 2 per cent between 2018 and 2019.

The CEO of Top Glove had become one of the five new billionaires in the country within the year.