14/03/2024

PROLOGUE

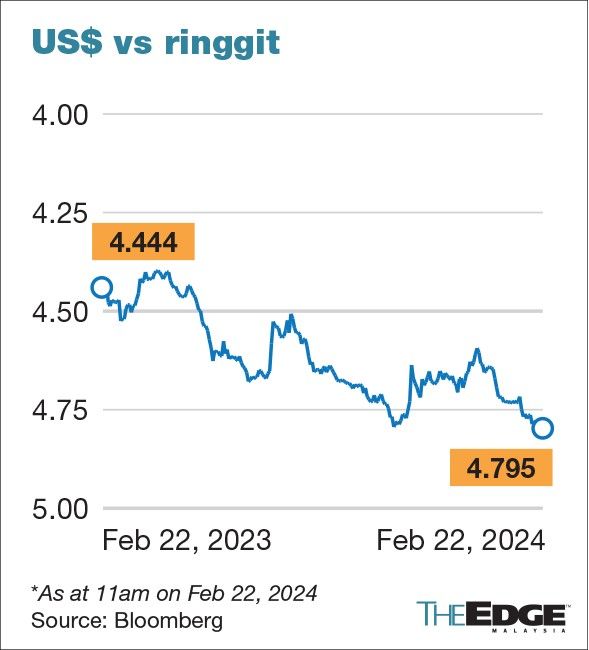

Malaysian ringgit’s fall has puts the central bank, Bank Negara Malaysia (BNM) on alert. The Country is ‘ready’ to intervene after its currency hits lowest level since the Asian financial crisis.

1] The Situations

The beleaguered Malaysian ringgit is testing levels not seen since the depths of the Asian financial crisis more than a quarter century ago, causing officials to step up their rhetoric to try and stem the slide. With U.S. interest rates at a 23-year high, capital has fled Malaysia as investors seek better returns elsewhere. They expect the Fed to start lowering its benchmark rate in June, as U.S. policymakers seek more evidence that inflation is firmly on a downward path before cutting rates. Fed Chairman Jerome Powell told the Senate Banking Committee on Thursday that U.S. monetary authorities were “not far” from having sufficient confidence in falling inflation to start reducing rates. The central bank has repeatedly attributed the fall in the currency to external factors, including U.S. interest rates and an uncertain Chinese economic outlook. The ringgit is undervalued, authorities say, and does not reflect the country’s positive economic prospects. As an export-driven country, a weaker currency would typically benefit the economy. But that also means higher costs for importers, raising prices of goods and services.

Source: Nikkei Asia

2] The Problems

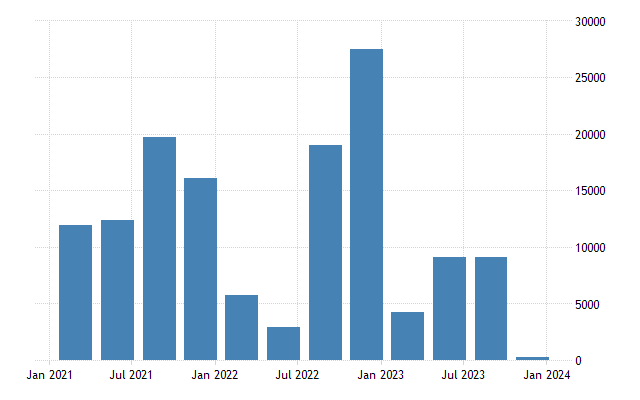

Malaysia used to run a current account surplus, which means that the country is earning more foreign exchange from goods and services exported than it is spending on imports owing to the then often strong shipments of electrical and electronic products. However, the current-account surplus, has

narrowed in 2023 to 1.3% of gross domestic product, the lowest in more than a decade, amid portfolio outflows as investors and traders scrambled out when the ringgit weakens.

Indeed, Malaysia’s current account (CA) surplus in the fourth quarter (Q4) of 2023 dropped to RM300 million or 0.1 per cent of the gross domestic product (GDP) on wider deficit in primary account due to larger outflows in investment income. As a comparison, in 2022, Malaysia’s trade surplus amounted to around 58.16 billion U.S. dollars.

Trade balance is the value of exported goods minus the value of imported goods. A positive trade balance signifies a trade surplus, while a negative value signifies a trade deficit.

Secondly, the financial account defici shall persist owing to external “structural reasons” amid the higher-for-longer US interest rates; this aspect is part of the larger spectrum of the neo-liberalism-is-imperialism discourse.

Since the Bretton Woods Agreements were adopted, the construction of an international monetary order is centered on the U.S. dollar. Other currencies were to be pegged to the US dollar which was at one time pegged to gold.

The U.S. dollar thus plays the prominent role in world currency, while replacing the British sterling pound but designating the U.S. a special position compared to the rest of the world. Henceforth, U.S. dollar at one time makes up 70 percent of global currency reserves, accounting for 68 percent of international trade settlements, 80 percent of foreign exchange transactions, and 90 percent of international banking transactions. Owing to this financial dominance, the U.S. dollar becomes the internationally recognized reserve currency and trade settlement currency. Therefore, not only the United States is able to exchange it for real commodities, resources, and labour, and thus to cover its long-term trade deficit and fiscal deficit, but she can also make cross-border investments, mergers and acquisitions of enterprises using U.S. dollars.

In a sense, the U.S. dollar hegemony provides one good example of the predatory nature of neoimperialism. The United States can also obtain international seigniorage by exporting U.S. dollars. She can reduce its foreign debt by depreciating the U.S. dollar or assets that are priced in U.S. dollars. The hegemony of the U.S. dollar has also caused the transfer of wealth from debtor countries to creditor countries. This would, in fact, mean that poor countries would indirectly subsidise the rich metropolitan Global North countries.

As it is, much higher interest rates – due to Western central banks – are suffocating developing nations, especially the poorest, causing prolonged debt distress and economic stagnation, (KS Jomo, March 2024).

[ The comprehensive threads on the Financialisation of Neo-imperialism are covered extensively in these sites: HERE1; HERE2; HERE3; HERE4 and HERE5). ]

Thirdly, the negative spread of the ringgit over US dollar interest rates, for the first time in history, has inevitably reduced the buffer Malaysian Ringgit (MYR) local markets have against a rather heightened global market volatility.

The uncertainties racking worldwide under a post-Covid pandemic are geopolitical situations: the Russo-Ukrainian special military operation, the wider MENA Hamas-Israel war, the deglobalisation-is-gaining-momentum effect on Geoeconomics of the two major economies in China and the USA, especially from heightened U.S. interest rates and an uncertain Chinese economic outlook.

Worsen by the fact that Malaysia’s largest trading partners are China, Singapore, Europe and US, where around 80% of the nation’s exports and imports are in the greenback US$. In reality, only between 4% and 5% of Malaysian trade are conducted in the ringgit.

Fourthly, and more vitally, there is a slow and policy implementation process to call GLCs (government-linked companies) and GLICs (government-linked investment companies) to repatriate their overseas earnings and begin to adopt an economic nationalism ethos by converting them into ringgit towards supporting the national currency. Indeed, “If implemented effectively, these gains could be significant,” according to ANZ Research. “Not only is Malaysia a net creditor economy, the stock of such non-reserve external assets is significant.”

The country’s GLICs have a total assets worth RM$1.84 trillion which is almost equal to the size of Malaysia’s nominal gross domestic product (GDP) this year.

Indeed, though PMX Anwar has mandated GLICs to increase their respective domestic direct investments, saying they have a responsibility to work together with the Madani government in ensuring economic growth and ensuing rakyat² expanding income instead of investing abroad, it will be some times to forsee any gradual repatriation of national funds and assets to homeland, (malaymail, 9/01/2024).

On another GLIC case instance, the Employees Provident Fund as at end June 2021, its investment assets stood at RM989.14 billion, of which 37% was invested overseas. By the Q3 2023, the EPF’s overseas investments generated RM$6.55 billion, or 45%, of its total investment income recorded, (kwsp.gov, December 2023).

During a 2024 dividends payment presentation on the 2023 EPF performance, it was stated that some 62% of the EPF’s RM$1.136 trillion investment assets are invested domestically, generating RM$31.71 billion, or 47% of total investment income. Global assets — which include those US tech stocks that boosted shariah dividends — generated RM$35.28 billion, or 53% of total investment income, while making up only 38% of investment assets in 2023, (theedgemalaysia 17/03/2024). This could be or might be attributed to the ringgit’s weakened performance that had boosted such abnormality returns.

Fifth, present economy scenario is compounded by contrary to net foreign inflow of RM$6.1 billion in Malaysian equities year-to-date, the local bond market recorded net foreign outflow of RM$3.23 billion. Heightened uncertainty and tightening global financial conditions have contributed to portfolio outflows from domestic bond markets and reduced inflows into the equity market in recent months.

Indeed, country’s revenue is not rising as fast as the increase in operating expenditure that is more than 95% of revenue since 2008.

In fact, from past records and datasets, total government debt and liabilities as of June 2022 was estimated to be at RM$1.42 trillion and would rise even further by the following year. Total debt and liabilities were then about 82 per cent of GDP.

When one was assuming the national economy destined to expand by 7.5% in nominal terms during year 2021 to RM$1,521.3bil, Malaysia’s official debt to GDP and total debt to GDP was then expected to be 64.1% and 77.9%, respectively, but it would not be so pulsating by year 2023 under an uncharted and rather unfriendly territory.

Historically, by 2022, it was already assessed that likely, there shall be many Uncertainties in Malaysia’s Economic Recovery, Cassey Lee, ISEAS, Singapore, 19/05/2022.

The sixth problematic measure policymakers should be focusing upon is to deal with the more persistent selling pressure. This process is to encourage exporters to convert their foreign currency proceeds on reversible basis with Bank Negara Malaysia to shore up the central bank’s reserves, rather than these values being a hold-up in foreign vaults.

Malaysia’s international reserve assets amounted to US$112.94 billion (RM$523 billion) in mid-2023, while other foreign currency assets stood at US$1.7 million, according to Bank Negara Malaysia (BNM), in 29 Aug 2023. However, the international reserves of Bank Negara Malaysia amounted to USD114. 3 billion as at 29 February 2024. The reserves position is sufficient to finance 5.4 months of imports of goods and services, but is only 1.0 times of the total short-term external debt.

It is also an era when odious outshore transferrence of wealth generated in the country that have had looted and leaked out, (icij January 2024). A Malaysian politician under the Pandora Papers probe linked to US$52 million offshore trust and UK, US property investments – in fact, nearly half of the international reserves of Bank Negara Malaysia.

A final, and finer, point rests upon micromanaging a process whereby Bank Negara Malaysia shall and should initiate a guideline or program on how to short-date onshore interest rates not only to be higher but in a calibrated way, too, and possibly also in a reversible manner.

All these approaches should be part and parcel of the MADANI ECONOMY to be SIRED in serving rakyat² to be well-served towards maintaining economic development sustainability.

3] The Degrowth

The spiraling cost of living associated with a depreciated ringgit resulting in a poorer balance of payments is but a cumulation of other factors:

A) Malaysia with the promotion of an equity ownership, a majority of foreign direct invesrments (FDIs) enjoys the liberalised condition of 100 percent ownership subjected to 80 percent or more of their production that are assembled for exports. Though at one time, the net flow of long-term capital account was encouraging, lately, the country’s export-led industry from the manufacturing sector had been lack-lustre due to a pre-matured de-industrialisation during the 1990s, and confronted by the Asian Financial Crisis that caused Malaysia’s GDP to shrink from US$100.8 billion in 1996 to US$72.2 billion in 1998. The Malaysian economy’s GDP did not recover to 1996 levels until 2003.

Malaysia’s full-year economic growth is expected to be at 3.8% in 2023, below the government’s projection of a 4% expansion and a sharp drop from a 22-year high of 8.7% in 2022.

B) The other major challenges facing the nation is a deficiency of a national platform with a defined visionary objective (and a governance mechanism and or organisational structure) in the present program of industrialisation with the Industry 4.0 Initiative and related programs, structures and approaches. Consequentially, the standards of Industry 4.0 related equipment, technologies and systems are regarded as ill-defined in conception and fuzzy in design and development, (STORM 2023, Industry Initiative 4.0).

The increasing FDIs, especially from China, are but blips if the skilled labour ecosystem is not enhanced to handle high-technology and high-value production processes sooner the better to hinge on a leading competitive edge over rival ASEAN countries.

According to the World Investment Report 2023, US$223.307 billion in FDIs flowed into Asean in 2022 — the highest since 2010 and an increase of 27.44% from 2021, with the US being ASEAN’s largest FDI investor with US$40.2 billion worth of FDI in 2021, representing 22.5 percent of total FDI flowing into ASEAN.

TA Securities expects the sentiment of the semiconductor sector in Malaysia to improve gradually, underpinned by an anticipated recovery in global demand as well as increasing trade diversion opportunities as a result of the China Plus One strategy.

The China Plus One Strategy, also known as Plus One or C+1, is a supply chain strategy that encourages companies to minimise their supply chain dependency on China by diversifying the countries they source parts from. It is about leveraging the strengths of multiple hubs to build a more resilient, agile, and cost-effective supply chain. An example shall say, include investments to build a chip-testing and packaging factory in Malaysia, a mines-to-manufacturing electric vehicle supply chain in Indonesia, and an expansion of consumer electronics production facilities in Vietnam.

C) We still have the issue of economic nationalism which is still pervading the nation, after more than 65 years of ethnocapital-ethnocratic-clientel-capitalism reinforcement, there is not much to show except as a development of underdevelopment-under-monopoly-capitalism. The relationship between economic growth and ethnic diversity (Agostini et al., 2010, Gören, 2014, Iniguez-Montiel, 2014) is grounded in compendium of economic literature that finds that ethnic heterogeneity does induce social conflicts and violence, which in turn, could affect economic growth, too (see Easterly and Levine, 1997, Mauro, 1995, Montalvo and Reynal-Querol, 2005). The negative consequences of such ethnic diversity imply that unless adequate and appropriate policies are executed to ensure that the benefits of any economic growth are equally shared among all ethnic groups, otherwise economic development, and consequent economic growth are impaired. The glaring fact that despite many Kongress Economik Bumiputera (KEB), these conventions have only dragged the nation further into sovereign indebtness, underdevelopment in many states, and whereby the acuteness of poverty is even sharpened and much wider as reflected in the EPF’S saving ratios where the top 20% (T20) of EPF members possess 82.5% of the total savings, but the

The continuing in-depth studies by Gomez, with Jomo and Lim Mah Hui – collectively critical of selective privatisation and bumiputera equity quotas, and in the promotion of money politics that are dastardly detrimental to national economic development; view GOMEZ affirmative policy @UN University, and read also the 50 years NEP hasn’t worked and the various articles in NLM#10 only portent more problens in the implementation of the Madani Economic Model (MEM) where there are major disagreements on the MEM principles that have stretched from the theological aspect within a secular society (Bakri; Tajuddin; Hunter) with an uncertain economic Islamic impact upon non-muslims (Ignatius; Ramakrishnan; Ignatius2), to the complications of managing complexity in economic developmental execution (UNICEF; World Bank, 2022; and World Bank, 2019); STORM; Ramesh Chander, Murray Hunter, and Lim Teck Ghee) while trying to achieve a post-ABIM script (Mohktar).

D) Whereupon the poor and underclass have a bleak future because the upper class is well-entrenched…..

“Those attending the Bumiputra Congress come from the upper class.”

Indeed, the recent 7th edition of KEB is no more than a gathering of bumiputera elites to enlarge and extended opportunities for themselves and their peer cronies.

Much pre-determined is that this congressional conference will be beneficial to the GLCs, and their crony contractors and collaborators,(Hunter 2024; see also The 3 things we learnt from KEB, Syed Jaymal Zahiid).

In a post-colonial society, the capitalist class in charge of the state-directed capitalism is termed the ‘bureaucratic bourgeoisie’ and would comprise bureaucrats businessmen, leading politicians and professionals; where membership of such a class is determined by the control over or closeness with the state apparatus, overtly or covertly, (Ahmad Fauzi Abdul Hamid, “Development in the post-Colonial State: Class, Capitalism and the Islamist Political Alternative in Malaysia“, Kajian Malaysia, Jld. XVIL No.2, Disember 1999).

E) In an eastasia forum (EAF) posting, there is an editorial piece on Malaysia’s economic reform still caught in the baggage of the old politics, published 29 January 2024 by the Australia National University.

Our analysis is that the present strategy of brokering access to state power in exchange for loyalty has led to slower progress on economic and democratic reforms, leaving Malaysia’s issues of socioeconomic inequality and middle-income issues unresolved, (refer to STORM 2024 , a trunkful of dirty linens)

- In NEP-inequality-ethnocractic-hegemony, we have elaborated upon not only on the inequity application of the National Economic Policy ( newleftmalaysia,

- Ethnic Inequality and Poverty, but the finance monopoly capitalism residence in the national economy that retarded our economic performance in comparison to other southeast Asian countries. The other weak policy articulation includes the acceptance of neoliberalism-is-neo-imperialism as the developmental model so much so that the country incurred indebtness through-and-by-neoimperialism with the unhealthy involvement of IMF / World Bank intruding into emerging and developing economies, (see IMF on Malaysia). The resultant outcome is poverty debts and inequality spreading into the urban sector where three-fourths of Malaysians reside. The UNICEF 2020 Report has shown that low income female-headed households are exceptionally vulnerable. World Bank advocating of high growth rate only aggravate an economic situation encouraged and encrouched by monopoly-capital, especially since the continuance of neo-colonialism post-independence and in furtherance the penetration of neoimperialism onto Malaysia in the form of financialization capitalism.

- With the advent and advancement in the financial liberalization process, finance capital is thus no longer just serving industrial capital, but has far overtaken it. The financial oligarchs and capital rentiers are in dominance; more so, with an ethnocapital insertion, and an assertion, in the govertmenr link-companies and the national banking sector; see STORM, April 2021, Class analysis of banks and corporate capital; to read also, Colonialism, Capital and Class {forthcoming}.

EPILOGUE

When inflation is high, Bank Negara Malaysia (BNM) will set about undoing these actions by tightening monetary policy, and markets will make you pay with higher bond yields. Boost the economy with borrowed money, and you will see the gains clawed back by higher interest rates. The resulting economic contraction and inflation will erase whatever economic gains through “freebies and free lunches” through subsidies.

Always remembering that subsidies stimulus is a class war waged against the 99 per cent by the elite 1 per cent. Often the money extracted from the working class through inflation is transferred to the rich as subsidies and tax cuts to promote capital accumulation.